商用车

2023-02-03

政策的转变是否会阻碍2023年中国新能源商用车市场的发展?

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

Amid a sluggish period for the truck and bus market in China, new energy vehicles and exports provided industry OEMs with a glimmer of hope in 2022. During that year, sales of new energy buses and trucks in China reached an all-time high, totaling 238,000 units, an increase of 90% on 2021.

Sales of new energy trucks and buses increased by 90% compared with 2021

Record high registrations in 2022

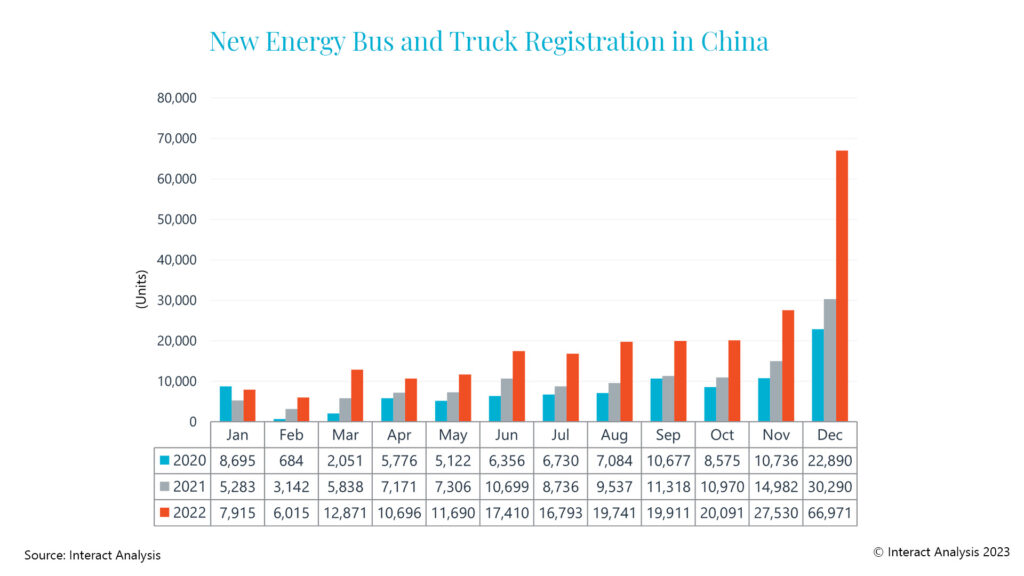

Ahead of the cancellation of national subsidies in January 2023, registration of new energy buses and trucks in December peaked at a total of 67,000 units, an increase of 121% year-on-year. Total registrations stood at 238,000 in 2022, accounting for 9.2% of total commercial vehicle registrations – up by 6 percentage points from 2021.

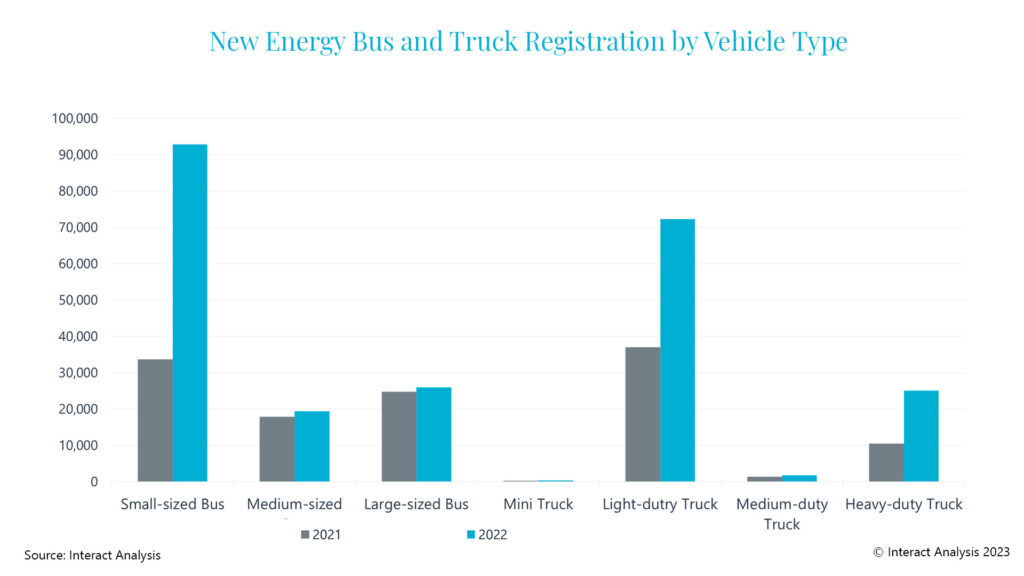

In terms of vehicle type, the new energy bus market remained larger than trucks, making up 58% of total sales, totaling 138,000 units. Small-sized buses took the lead in terms of growth, registering a 180% year-on-year growth rate to nearly 93,000 units in 2022, while large- and medium-sized buses witnessed growth rates of a mere 5% and 8%, respectively. In the truck segment, registrations doubled compared with 2021 to over 99,000 units, of which, light-duty trucks accounted for 72,000, an annual growth rate of 95%, giving it an overall share of 73% of the new energy truck market.

In terms of sales, small sized buses and light duty trucks lead the way

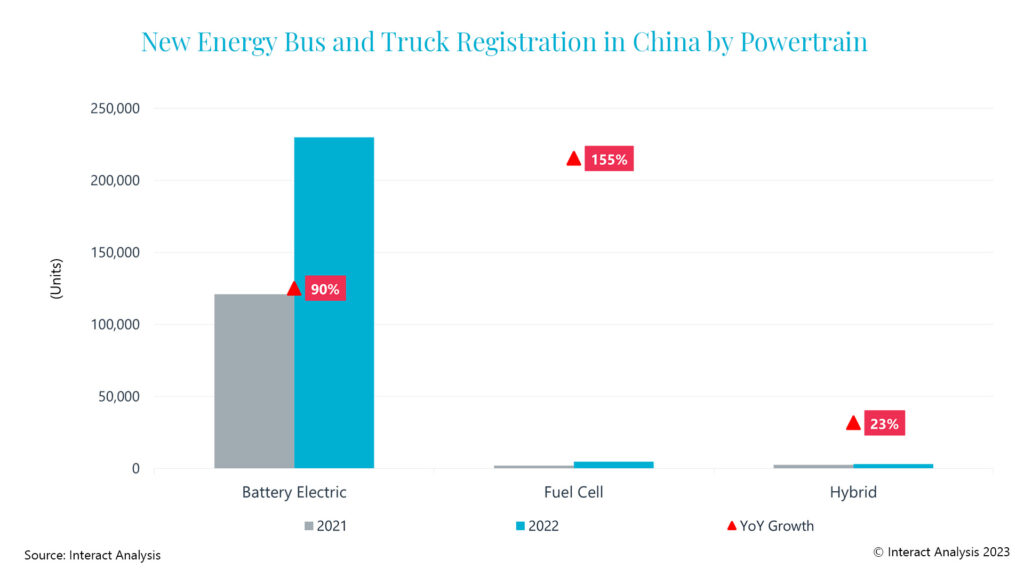

When it comes to powertrain, battery electric remained the dominant choice for new energy buses and trucks, equating to 97% of total units. Thanks to an uptick in demonstration projects nationwide, sales of fuel cell vehicles increased by 155% to 4,782 units in 2022.

Battery electric powertrain is by far the most dominant type for new energy trucks and buses in China

Sky-rocketing sales of new energy buses and trucks drove a buoyant powertrain component competitive landscape. Over 70 suppliers supplied batteries for new energy buses and trucks in 2022, with total installation up by 55%. Total drive motor installations reached nearly 240,000 units, registering an 89% annual growth rate. Installation for fuel cell systems totaled nearly 4,800 units and 473,000 kilowatts for the year.

Will market growth continue in 2023?

From January 1st, 2023, a decade-long national subsidy from the Chinese government for new energy vehicles was officially scrapped . This indicates that sales of China’s new energy buses and trucks are transitioning from policy-driven to market-driven. Coupled with the ‘last minute rush’ buying in December 2022 (registrations soared to 67,000 units) and the impact of the Chinese New Year holiday, sales of new energy commercial vehicles are anticipated to take a hit during the first couple of months of 2023. The market is expected to experience a ‘gradual upward’ trend throughout the year, reaching around 300,000 units.

Although the subsidy has been withdrawn, the Chinese government will still be devoting attention to the new energy industry. Favorable policies spanning purchasing tax exemption, right of way, subsidies for hydrogen vehicles, support for infrastructure construction and so on will remain in place to support development of the market. In 2023, new energy light-duty trucks and buses will retain the lead in terms of sales. Additionally, the fuel cell vehicle segment will remain robust in 2023 – with new projects rolling out in many regions.

It’s worth mentioning that exports of new energy buses and trucks have accelerated in the past couple of years, reaching more than 35,000 units in 2022. This trend will maintain its growth momentum in 2023 and onwards.

For more information on the new energy commercial vehicle market in China, contact Shirly Zhu, Principal Analyst at Interact Analysis.

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口