工业自动化

2023-03-28

2022年全球精密减速机市场增长17%

Alexander Jones

Alexander拥有天体物理学博士学位,具备出色的分析和建模能力。他负责支持工业自动化领域的研究,专注于运动控制和智能输送。

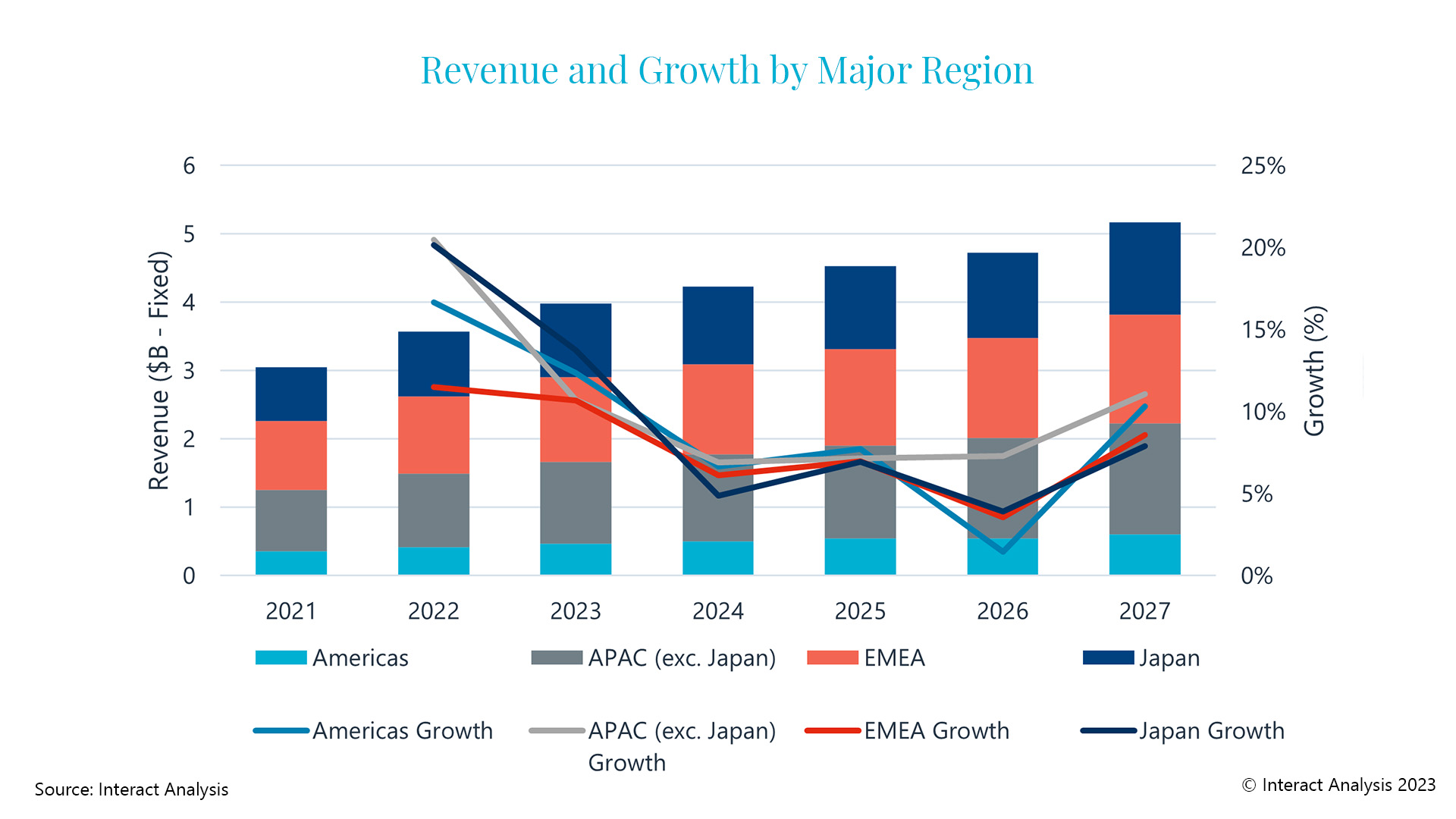

New research from Interact Analysis shows the precision gear products market enjoyed exceptional growth throughout 2022. Growth is forecast to remain high in 2023, but to a lesser extent than the previous year, with the global market expanding by a CAGR of 7.7% between 2022 and 2027; from $3.6B to $5.2B.

APAC is by far the fastest growing market for precision gear products. In 2021, the market was worth $900M growing by 20.5% in 2022 to a worth of $1.1B. Following closely behind was Japan, registering a growth rate of 20.1%, worth $950M in 2022 . However, while APAC was the fastest growing market for precision gear products in 2022, EMEA remained the largest. There is a clear link between the region having the biggest manufacturers of industrial robots and being the leading market for precision gear products, as the industrial robot market is the largest overall market for geared products. EMEA accounted for 33% of the precision gear products market in 2021, followed by APAC (29%) and Japan (26%).

Industrial robots present the greatest opportunity for the precision gear products market because the industry requires precise, controlled movements. Overall, almost all precision gear products are sold into machinery sectors but very rarely to manufacturing end users. In 2021, the market value of gearboxes sold into the industrial robot market reached $1B, which contributed 32% to the total precision gearbox market. By 2027, this figure is predicted to grow to $1.9B. Other major consumers of precision gear products include the metal cutting, packaging machinery, semiconductors, materials handling and electronics machinery sectors; all of which combined accounted for 60% of the total market in 2021.

In terms of supplier landscape, Nabtesco and Harmonic Drive dominate the market, both of which are based in Japan, supplying most of the components into the industrial robot segment. Along with Wittenstein, these three companies accounted for 50% of the global market in 2022, making it highly consolidated. Overall, APAC-based suppliers control the lion’s share of the market and tend to perform better than those based elsewhere.

Alexander Jones, Research Analyst at Interact Analysis, comments, “There is a combination of factors which are both helping and hindering growth within the precision gear products market. While the COVID-19 pandemic has spurred on the need for automation, short term growth has been negatively affected as suppliers focused their efforts on production rather than research and development of new technologies. Nevertheless, the ever-increasing demand for robotics will help drive sales for precision gear products.”

About the Report:

A new Interact Analysis market report providing highly detailed insight and analysis into the precision gearbox & geared motor market.

The report is built through extensive primary research and supplier reporting and utilizes data from Interact Analysis’ “Manufacturing Industry Output Tracker (MIO)” – highly regarded for its industry forecasts by country, which will inform the forecasts for precision gear devices at a country-level.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com.

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口