工业自动化

2022-05-13

物理和结构测试设备市场正在快速发展

Tim Dawson

Tim是工业自动化团队的高级研究总监。他拥有20多年的制造业产业研究经验,经常在全球各地的会议和行业贸易展上发表演讲。

The race to introduce new and more sophisticated products across a wide range of manufacturing industries, from consumer products to aerospace, puts time stresses on research and development processes where testing of materials and prototypes is key. The measurement of vibration, noise, fatigue or temperature, or any combination of those in multiphysics tests, may require hundreds of sensors and involve procedures which can last months. If a testing equipment vendor can provide kit which gives swifter results, this can bring significant added value to a product by speeding up the R&D process. As a result, the market for physical and structural testing equipment is evolving fast, and this insight takes a look at the landscape in three industrial sectors: aerospace, automotive and industrial machinery.

Aerospace – A healthy outlook after a lean time

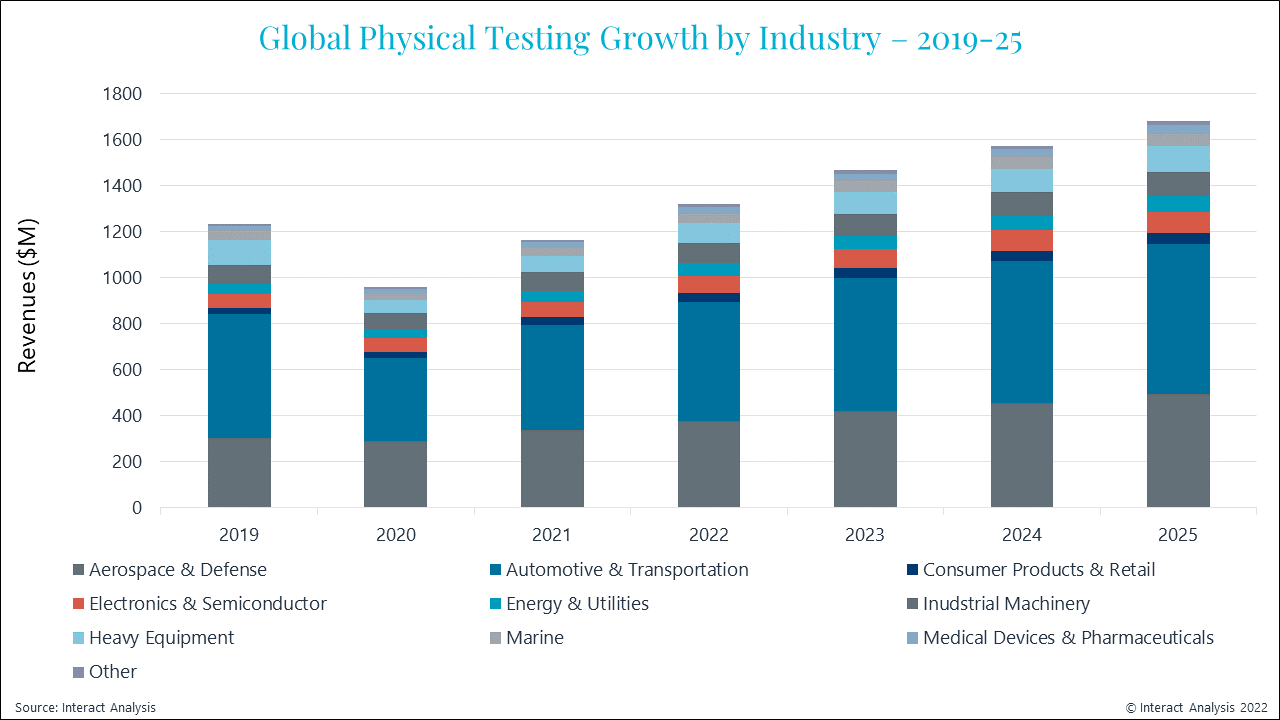

Aerospace and defense account for 30% of global revenues for testing equipment, and our research shows sales to these sectors will grow well above the market average throughout our forecast period (which extends out to 2025). Considering how aerospace suffered during the pandemic, the increasing demand for testing equipment as the industry has rebounded has been impressive, particularly in the EMEA region. High gas prices may cool things down a bit, but there is a lot of positive sentiment in the sector.

There is increasing use of finite element analysis in testing in aviation. The software has reached a degree of sophistication where modelling or virtual tests and analysis are reliable. A lot of physical testing is also required, creating a healthy market for suppliers due to the requirements for increased expertise and higher channel counts. As one supplier said: “We would like to work more within the automotive sector, but there seems to be a high cost of entry. Aerospace customers have strong demand for our products, and it’s a higher profit margin, so it’s a secure arena for us currently.” Suppliers specializing in vibration testing and data acquisition equipment are expected to benefit from key growth opportunities in marketing to this sector.

The market by industry – aerospace accounts for 30% of global revenues

Automotive – electrification offers opportunities, simulation poses a threat

Globally, automotive testing accounts for more than 40% of the market, but physical testing equipment revenues were badly hit during the pandemic and won’t exceed 2019 levels until 2023. The automotive industry is very mature, and manufacturers have tended to stick by legacy products where testing equipment is concerned. Although there will be growth opportunities offered by the push to electrification, when secondary noise and lighter weight material testing will create demand for new technologies, not anticipate an explosion in demand.

That said, with automotive OEMs operating at about 50% capacity owing to the current average 93-week lead times for microchips, testing equipment suppliers are likely to feel the pressure when the semi-conductor situation eases and demand gets back to normal, potentially by 2023. Simulation may pose a threat to physical testing – maybe not a major one, but significant enough to pressure testing equipment suppliers to become more adaptable and offer different solutions, including virtual ones, in order to maintain a healthy position in the market.

Industrial machinery – predictive maintenance forging new relationships between testing equipment suppliers and end users

Key customers for testing equipment in this sector are pump, fan, and compressor OEMs, as well as big motor vendors such as ABB, Siemens, and WEG. The market for industrial machinery is mature, and historically this sector evolves at a slow pace. But demand for smart machinery is on the increase, with spiraling energy costs driving the need for greater energy efficiency. A major opportunity for testing equipment manufacturers is the trend for more and more end-users in the machinery market to rely on predictive maintenance. Testing equipment suppliers are starting to work more closely with end-users to ensure that unplanned machinery down-time can be minimized. There are market opportunities here, but it is up to vendors to step in and educate end-users. Wireless data acquisition, telemetry-based acquisition and digital sensor technology are the key trends at work in this sector.

To continue the conversation about physical and structural testing equipment, contact Tim Dawson today: Tim.Dawson@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方