工业自动化

2023-01-16

新玩家将如何影响智能输送系统技术市场格局?

Tim Dawson

Tim是工业自动化团队的高级研究总监。他拥有20多年的制造业产业研究经验,经常在全球各地的会议和行业贸易展上发表演讲。

Smart Conveyance technology is a multi-carrier transport technology in the form of either Linear or Planar types. The market is relatively immature with most entrants having joined in the last 5 years. The technology is a premium solution making it a more expensive option compared with traditional transfer and conveyor systems, which are already well established within their markets. In this insight, we will take a deeper look at the highly dynamic market for smart conveyance technology, some of the key players, possible new entrants to the market and discuss some of the benefits to users of this technology.

The Global Picture

Since the majority of smart conveyance technology vendors are headquartered in Europe, EMEA was the largest market in 2020, registering a total market value of around $100 million. Closely following behind was Asia Pacific ($84 million) and the Americas ($50 million). Despite being second historically, the APAC market is set to surpass EMEA during 2023, as linear smart conveyance technology gains traction in the region. By 2026, the APAC smart conveyance technology market is anticipated to be worth $450 million, ahead of $350 million for EMEA and $185 million for the Americas. The market is set to quadruple in size between 2020 and 2026 with a CAGR of 26.5%.

New entrants set to shake up the supplier landscape

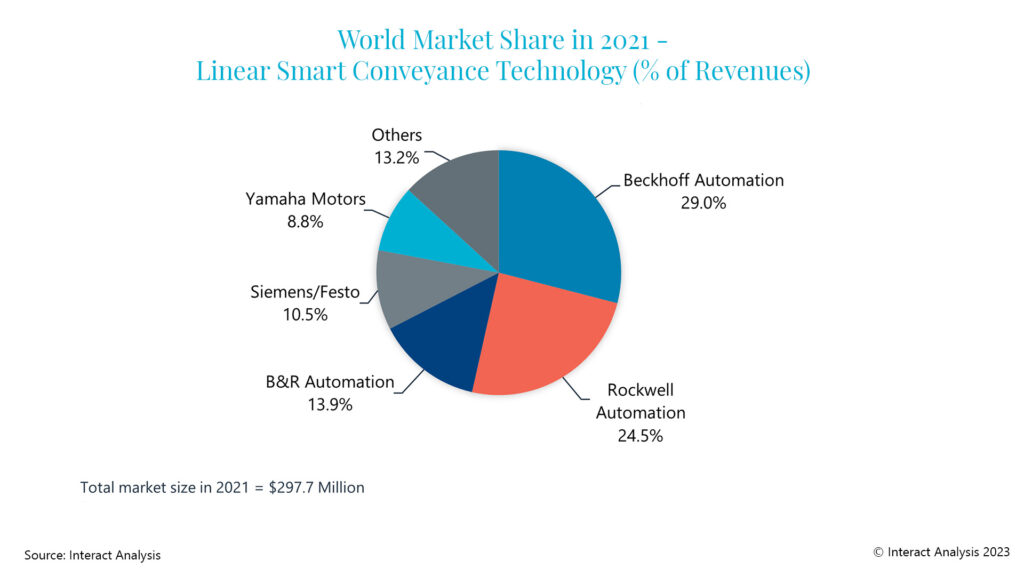

Currently, two dominant vendors represent more than half the market: Beckhoff Automation and Rockwell Automation, with global market shares in 2021 of 29% and 24.5% respectively. Nevertheless, Interact Analysis’ research suggests there will be new key market entrants to watch out for.

In October 2021, Schneider Electric entered the market with the launch of its Lexium MC12 multi-carrier system. Schneider is the largest vendor to have launched a linear smart conveyance product post 2020, but there have been limited new entrants since then. This may be the effect the pandemic has had on manufacturing in limiting the education of end-users on new technology, as vendors instead focus their efforts on production rather than research and development for new technologies.

However, Motor Power Company is another new entrant who recently unveiled the Independent Linear Synchronous Motors (ILSM) product. The solution is fully customizable and is stated to be compatible with any company’s PLC, making the new product attractive to users.

Most recently, Bosch Rexroth launched a new planar smart conveyance technology system ctrlX FLOW6D, which incorporates free-floating transport systems to allow for high-performance transportation and freedom of movement. Planar systems can offer extreme flexibility (beyond the capability of linear systems) and can work overhead, horizontally or vertically.

Beyond this, Interact Analysis has conducted new research with a number of automation vendors who offered clear intention to launch new smart conveyance technology products in the coming years. The majority are already producers of linear motors or servo technology and some vendors are expected to emerge from the increasingly technology-led Chinese market. These new market entrants, who haven’t yet made themselves public, could dramatically change the global supplier landscape in the future.

Beckhoff and Rockwell currently retain the lion’s share, but new entrants have the potential to alter the supplier landscape dramatically.

Growth driven by manufacturing output and automation demand

Overall, growth in manufacturing output and automation in general will increase the demand for smart conveyance technology. This, coupled with the enhanced flexibility and space saving benefits the technology offers, is likely to make solutions more attractive to users over the forecast period. The growth of digitalization, Industry 4.0 and mass customization will also undoubtedly positively affect the market for this technology. Smart conveyance systems will allow manufacturers to connect their production lines to the ‘cloud’ so that data can be collected and stored for full optimization and reduced machine downtime. As the concept of smart conveyance technology is more widely accepted, larger projects with greater track lengths will also be deployed, subsequently increasing revenues for vendors and expanding the market as a whole.

Final Thoughts & Advice

The market landscape for smart conveyance technology is highly dynamic and poised for growth and new entrants will undoubtedly shake up the current global outlook for this immature market. In order to penetrate the market, vendors should be educating customers on the benefits of this technology against the traditional servo drive and motor technology. End-users requiring highest possible throughput in their machinery and equipment are likely to benefit the most from the flexibility offered by smart conveyance systems.

Stay tuned: in the second half of 2023, Interact Analysis will be updating its smart conveyance technology market report, which will include updated market share data considering new entrants to the market.

For more information on the market, contact Tim Dawson, Senior Research Director at Interact Analysis.

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方