工业自动化 机器人 & 仓储自动化

2022-05-30

协作机器人新趋势:从大型有效载荷,到微型有效载荷,到可移动性

MAYA XIAO

Maya在电动汽车、自动化系统和机器人领域拥有跨学科的技术背景,现担任Interact Analysis的研究经理,负责锂离子电池、叉车、工业和协作机器人市场等研究。

Cobots are becoming a mainstream technology. As they do, new varieties of cobot are being released, and new industries are being targeted. In this insight, we take a look at a few growing cobot trends.

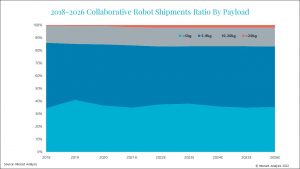

Payload: bigger and smaller cobots taking an increasing market share

In 2021, light duty cobots (with payloads of <10 kg), accounted for 83% of total shipments. Larger payload cobots (with payloads of >10 kg) accounted for 17%. This market share will grow slowly over time, particularly in the 10-12 kg range as they penetrate new scenarios where heavy lifting is involved such as the semiconductor industry, automotive and logistics. Mainstream cobot manufacturers such as UR, Techman and AUBOare leading vendors of models with these larger payloads. Additionally, because heavier cobots are more expensive, the market share increase in terms of revenue will show a more impressive increase, from 20% in 2021 to 25% by 2026.

Large and small cobot variants are gaining market share.

At the other end of the spectrum, very small collaborative robots are also gaining traction in the markets. Desktop collaborative robot arms with payloads of around 500g are seeing greater use in precision operations in industries such as electronics. Kawasaki, ABB and DOBOT are big players here.

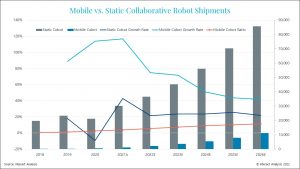

Mobile cobots gaining market acceptance

The mobile collaborative robot, such as those produced by FANUC, where the collaborative arm is mounted on a mobile chassis, has to date seen fairly limited deployment across the industrial sector, though mobile solutions have already seen strong penetration in some markets. The main barriers have been technological – how to achieve integrated functionality across key parts of the robot – the chassis, the sensors, the robot arm, and the end-effectors. These challenges have had an impact on pricing. But technology has advanced, and we are seeing greater market acceptance of these machines.

The semiconductor industry – a sector which is a major investor in automated equipment – accounted large portion of mobile cobot deployments in 2021, the technology being applied in such scenarios wafer manufacturing and packaging, as well as loading, unloading, and material handling. The second largest end-user of mobile cobots is the new energy sector, where applications include power inspection, data center inspection and the screen-printing process in the photovoltaic industry. Meanwhile, the third largest market is consumer electronics.

We see huge potential in the application of mobile cobots on manufacturing production lines, because they bring the flexibility that modern manufacturing increasingly demands. However, mobile cobots can also be quickly deployed in non-manufacturing scenarios such as warehouses and automated supermarkets. Other niche applications being researched or piloted are education, medicine, file management and pharmacy management.

Mobile cobots will hold 10% of the cobot market by 2025.

We anticipate that mobile cobots will make up more than 10% of the total cobot market by 2025, and that there will be over 11,000 units shipped in 2026. Whilst the technology will only take a minority share of the market, it will have a much higher year-on-year growth rate than its static counterpart.

Chassis and arm: mobile robot companies dominate integrated production of mobile cobot solutions

In the initial stages of mobile collaborative robot production, machines were developed mainly by enterprises that had mobile chassis and cobot production capabilities, such as Omron and Siasun. Systems integrators also played an important role, purchasing mobile chassis and collaborative robot arms for customized assembly. A recent trend has been for mobile robot companies and collaborative robot vendors to cooperate in the development and production of mobile collaborative solutions. At present, mobile robot manufacturers dominate the market with a near 70% share, with collaborative robot manufacturers also developing their own customized mobile solutions and taking a 10% slice of the market. Customer project focused integrators occupy the remainder, basing their offerings on their ability to tailor their solution to the needs of bespoke projects that they are already managing.

To learn more about the latest cobot trends, get in touch with Maya today: Maya.Xiao@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方

锂电池市场:产能规划与出货预期更新

最新机器人&仓储自动化洞察

2025年全球工业机器人出货量有望复苏

人形机器人核心硬件的发展现状和趋势