工业自动化

2022-05-24

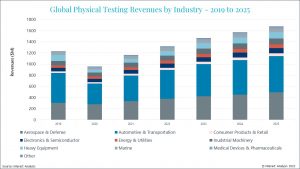

2022年全球工业测试设备市场收入比2019年增长7%,主要区域差异较大

Tim Dawson

Tim是工业自动化团队的高级研究总监。他拥有20多年的制造业产业研究经验,经常在全球各地的会议和行业贸易展上发表演讲。

The global market for physical testing almost got back to 2019 levels in 2021, and total revenues for 2022 will be 7% above those of 2019. Physical testing is evolving fast. The pressure is on suppliers to offer highly technical solutions that collect and analyse data more rapidly in order to allow faster time-to-market. With these expectations come increasing prices for testing solutions. This, coupled with guaranteed government spending in the near future, and private investment in hybrid and electric vehicle technology, means that there is strong optimism in the testing equipment market. But to understand the industry properly, we need a regional perspective.

Total revenues for 2022 will be 7% above 2019 revenues.

The Americas: Aerospace a major driver of demand

Sales of physical testing applications took a major hit in the Americas in 2020, with an overall dip in revenue growth of -26%. This was countered by a 19% growth bounce-back in 2021. 2022 growth is projected to be 14%. While noise vibration and harshness (NVH) testing equipment will continue to be the biggest revenue earner up to 2025, its 7-year CAGR between 2019 and 2025, at 2.1%, will be nowhere near that of the more sophisticated multiphysics and data acquisition (DAQ) testing technologies, where revenues will grow with a CAGR of 12.1%. Over the forecast period, total revenues for all categories of testing equipment are expected to be >$3bn.

Although the top five testing equipment vendors account for 57% of the market, the market is actually quite fragmented, with diverse niche opportunities driving innovation, such as demand for sophisticated testing kits from the electric and autonomous vehicle sectors. We are seeing increased demand for simulation solutions, particularly from automotive and aerospace OEMs, but this is not a threat to the physical testing market. Inflation may dent consumer confidence and stifle investment to some extent over the next 12 to 18 months, but the indications are that commercial and government investments will remain healthy. Aerospace accounts for 30-40% of the Americas market and, with continued government contracts coupled with a growing need for higher channel count applications and highly engineered aerospace solutions, the sector will be a significant driver into 2022 and beyond. The war in Ukraine could further push growth.

Europe the Middle East and Africa (EMEA): A buyers’ market

Like the Americas, sales of testing equipment dipped sharply in 2020, by -26%, followed by 17% growth in 2021, and an anticipated figure of 13% in 2022. Again, the period 2019 – 2025 is going to see Multiphysics and DAQ applications lead the way in terms of revenue CAGR – 12%, with NVH equipment again being the biggest testing segment, but with a much smaller CAGR – 2%. Total revenues for testing equipment over the forecast period will be almost $3bn.

The EMEA region is diverse, but the top five suppliers still account for 55% of the market. In Germany, France, and the UK it is common for the top five to hold a 60-75% market share but over time we expect that concentration to decline. In the Middle East and Africa there is a high degree of brand loyalty among industrial machinery and energy and utilities companies, so there is less competition than in other parts of EMEA where there are many smaller, specialized companies, making it easier for new players to enter the market. As the rebound of 2021 levels out, we anticipate 2024 will become a buyers’ market, with suppliers of testing equipment aiming at gaining market share, rather than revenue growth. Increased availability of virtual testing could also suppress the market.

Asia: Multinational companies attracted by growing market opportunities

With a -14% drop in revenues in 2020, the Asian market for testing equipment suffered the least. NVH and Durability and Fatigue (D&F) testing equipment are by the biggest segments in this region, with 2021 growth rates in India standing at 51% and 37% respectively, whilst the growth rate for Multiphysics DAQ stood at 4%. But over the 7-year period of this forecast in APAC, Multiphysics DAQ will lead in terms of revenue CAGR – 11%, as compared with 8% and 7% for NVH and D&F equipment respectively.

Every country in APAC has a different competitive environment. Generally speaking, the same companies that top the rankings in other regions are present in Asia, but some APAC countries have a very limited number of opportunities, so far fewer suppliers are present. China and Taiwan together account for almost 50% of the market for physical testing, and multinational suppliers are trying to break into these markets. Not only are the markets attractive, but most of the raw materials required for equipment production can be sourced in this region. Brand loyalty is very strong in the Asian market, and the perception is that Western brands will be the most reliable. We anticipate this will be a tough market within two years, as price increases will be slow, with high-cost suppliers of NVH and DVQ applications seeing pressure put on them as more vendors compete in the market.

To continue the conversation about physical and structural testing, get in touch with Tim today: Tim.Dawson@InteractAnalysis.com