工业自动化

2022-03-09

中国制造业放缓,竞争对手正迎头赶上

ADRIAN LLOYD

Adrian在技术领域具有20多年的研究和分析师团队管理经验。20多年来,Adrian一直积极参与技术市场研究,主要研究领域一直为工业自动化。他开创了众多被分析师们广泛使用的数据分析技术和方法,并创建了诸多测量框架,用于测量从工业自动化产品到半导体的众多技术市场。

Chinese manufacturing output emerged from 2020 relatively unscathed due to strong COVID-19 measures. But now the Chinese economy has slowed down and competitors are catching-up.

Slowing growth after a strong first quarter

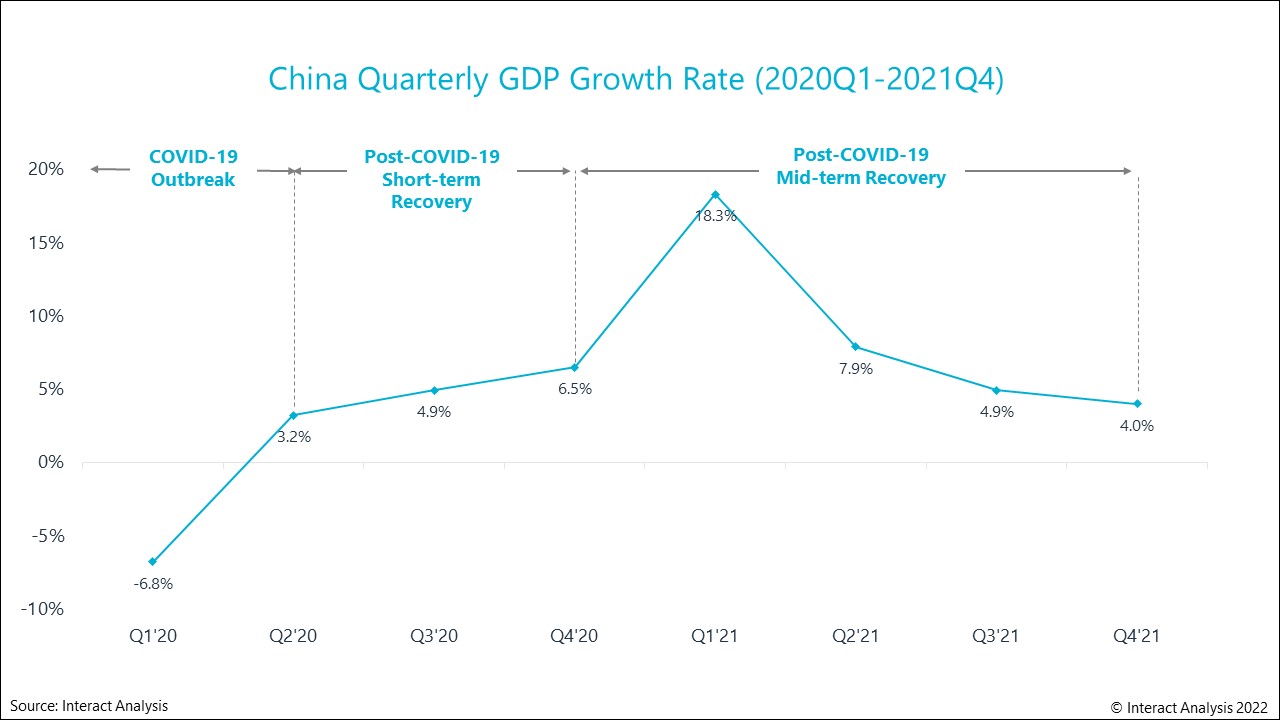

China’s GDP grew by 8.1% in 2021. This was largely due to the 18.3% COVID rebound in the first quarter (Q1). Meanwhile, the remainder of the year saw strong downward pressure, with growth coming in at 7.93% in Q2, and 4.9% and 4.0% in Q3 and Q4 respectively. This was due to a range of factors. While in Q1 government fiscal policy was focused on measures which enabled the economy to bounce back. For the rest of the year policy was directed more by medium and long-term considerations, and was slower in its implementation. Investment declined as a consequence.

Growth in the Chinese economy is slowing after a strong first quarter

Among those medium- and long-term-focused measures, those implemented to reduce carbon emissions had the impact of limiting production in energy-intensive industrial sectors. Furthermore, the re-emergence of the virus and the acute shortage of semiconductor chips, also contributed to downward pressure.

Exports to struggle in 2022

We predict China’s economic growth will register at 4.5%-5% in the coming year. This is lower than the target of 5.5%, the lowest for 3 decades, set by the government and reported in the Wall Street Journal this month. Export markets will particularly struggle. Commerce Minister Wang Wentao warned at the end of February of “massive pressure in maintaining high export growth” following a strong period last year when exports were boosted by high overseas demand for items needed to control the spread of COVID. The global environment for foreign trade looks tough throughout 2022, with supply chain blockages continuing, shipping prices remaining high, and labor shortages and rising energy and commodity prices further complicating matters. Of particular concern for China is the impact on supply chains the crisis in Ukraine might have. On top of that, the country will have to endure growing competition from recovering South-East Asian economies.

Investment always recovers slowly, and the decline we saw in the second half of 2021 will be followed only by a gradual 4.5%-5% rise in 2022. This will have a limited effect on economic growth. However, investment in advanced manufacturing will grow rapidly as China pursues its ‘Made in China 2025’ policy of industrial modernization and transformation. Sustainability and green energy will be key drivers here. But rising costs and the downward pressure on export markets will impact on growth. Nearly 90% of manufacturing investment will be private investment.

Growth: rest of world plays catch up

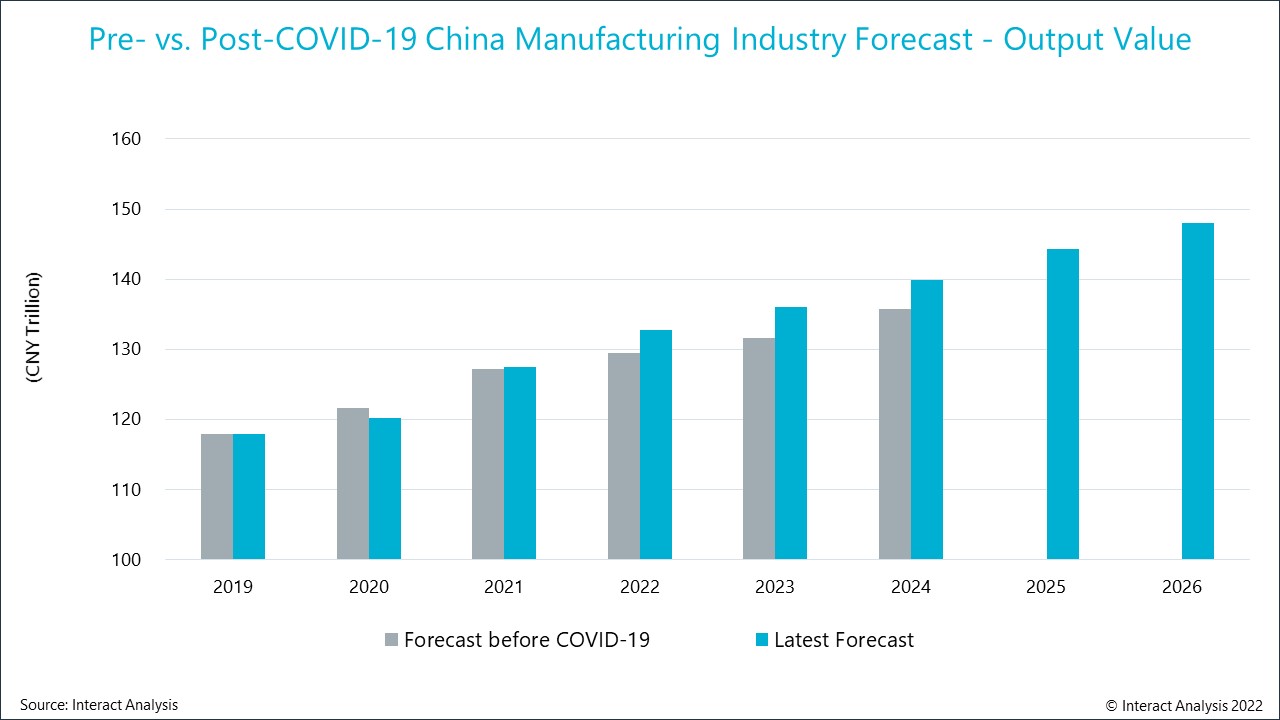

From 2021 to 2024, post-pandemic forecasts outstrip pre-pandemic ones

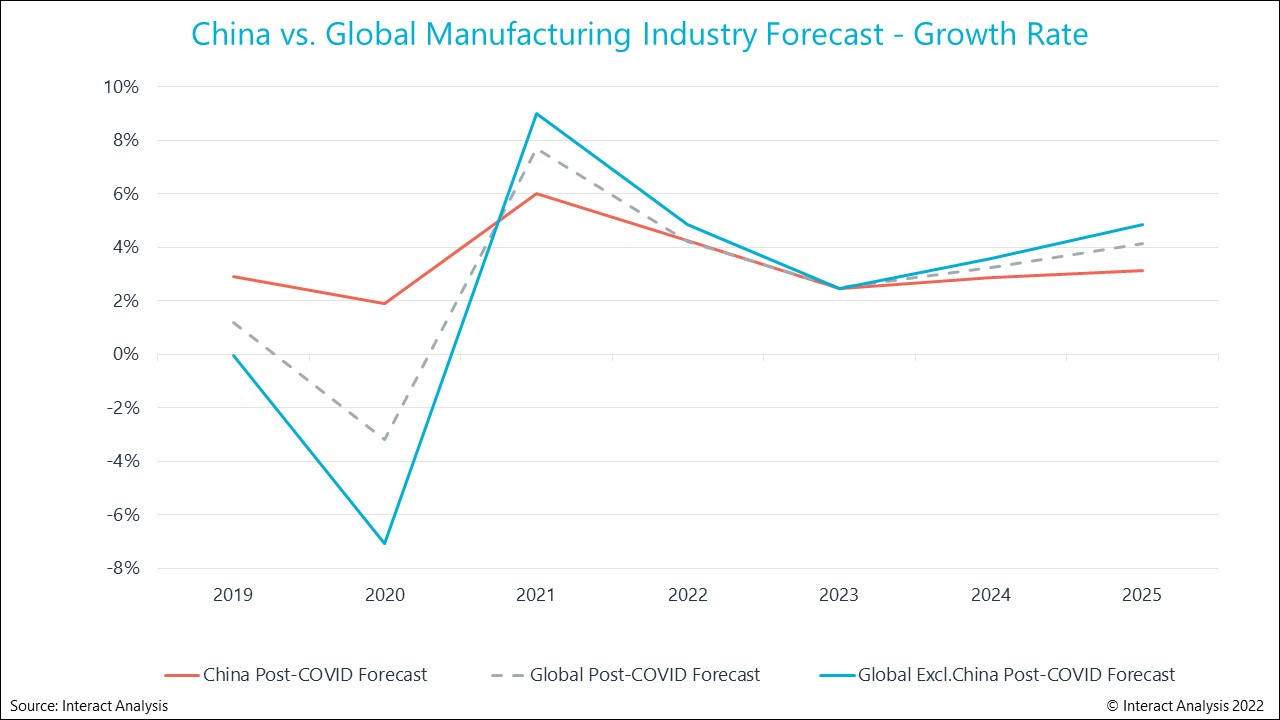

The chart above shows a comparison of our forecasting for Chinese manufacturing output made before and after the pandemic. Note how from 2021 to 2024, post-pandemic forecasts outstrip pre-pandemic ones. A measure of the resilience of the Chinese manufacturing economy. However, in spite of the strong initial recovery and steady growth the region is predicted to see up to 2026, competitors are catching up. The late rebound of the region’s competitors will mean that, at least for a period, the growth rate of China’s manufacturing industry will lag behind that of its competitors. This is something the world has not seen for a long time.

For a period, Chinese manufacturing growth is set to lag behind the rest of the world

To learn more about Chinese manufacturing output, get in touch with Adrian directly: Adrian.Lloyd@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方