工业自动化

2021-12-09

新冠疫情中的中国制造业:反弹之后,压力显现

ADRIAN LLOYD

Adrian在技术领域具有20多年的研究和分析师团队管理经验。20多年来,Adrian一直积极参与技术市场研究,主要研究领域一直为工业自动化。他开创了众多被分析师们广泛使用的数据分析技术和方法,并创建了诸多测量框架,用于测量从工业自动化产品到半导体的众多技术市场。

Chinese manufacturing is under pressure from both ends: raw material and energy prices are rising sharply; while consumer demand is weak. However, despite considerable supply chain problems during the latter part of the year, the 4th quarterly update of our Manufacturing Industry Output (MIO) tracker, shows that Chinese manufacturing is on track to achieve 5.9% growth. This is a judgement that remains unchanged since our Q3 MIO update.

Q1 2021 saw 26.8% growth in manufacturing output

China’s GDP in the first three quarters of 2021 reached 82.3 bn yuan: a YoY increase of 9.8%. On a quarterly YoY basis, GDP increased 18.3% in Q1, 7.9% in Q2, and 4.9% in Q3. These figures reflect the sharp contraction in Q1 of 2020 followed by China’s very early post-COVID rebound in the second half of the year. The manufacturing sector actually enjoyed much higher growth than the wider economy, but saw the same trend, with 26.8% growth in Q1 of 2021, followed by 17% and 12.5% in Q2 and Q3 respectively. Meanwhile, total sales of consumer goods in China also reflected this downward pressure. The first half of the year saw a YoY increase of consumer goods sales of 23%. But Qs 1-3 saw growth of only 16.4%.

The pressure is on, but most manufacturing sectors are gaining added value

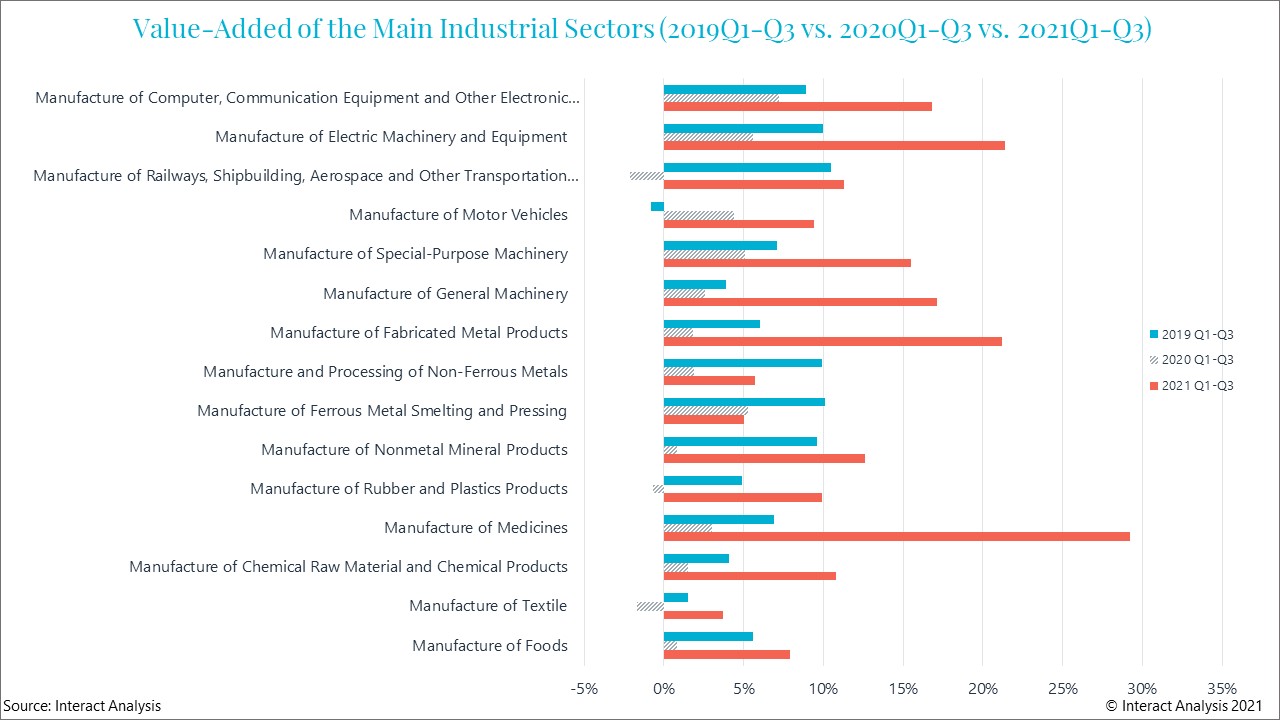

In spite of the pressures on manufacturing, the wider industrial picture is good. China’s National Bureau of Statistics looks at all industrial enterprises with a minimum revenue of 20 million yuan. They call this ‘industries above designated size’. They also look at something they call ‘added value’ – which means actual growth rate excluding price factors. Industries above designated size reported added value YoY growth of 3.1% in September, and of 11.8% for the January-September period.

Most manufacturing sectors are gaining added value

So it hasn’t all been bad news for industry, as we can see in the chart above. Though growth has slowed down as the year progressed, the increase in added value for most industries in 2021 (the red bar) actually exceeded the level for the same period in 2019 (the blue bar). The exceptions being industries in the metal processing sector, which is due to the current high levels of inventory and the consequent slow-down of demand. Perhaps unsurprisingly, it also looks as though COVID-19 has also had a major impact on added value in pharmaceutical manufacturing.

Export growth forecast to run at over 20%

In 2021 Q3, China’s exports still maintain growth of 20%+

February 2021 saw exponential YoY export growth. This can partly be explained by the extremely low value for the same month in 2020, when the initial COVID collapse was occurring. But it was also a result of continued disruption to supply chains in other parts of the world, meaning that countries turned to China to fill the gap. Q3 2021 has still seen export growth running at over 20%. And exports to the US, the EU, Southeast Asia, and the Hong Kong SAR have topped 300 bn yuan per region for the first time.

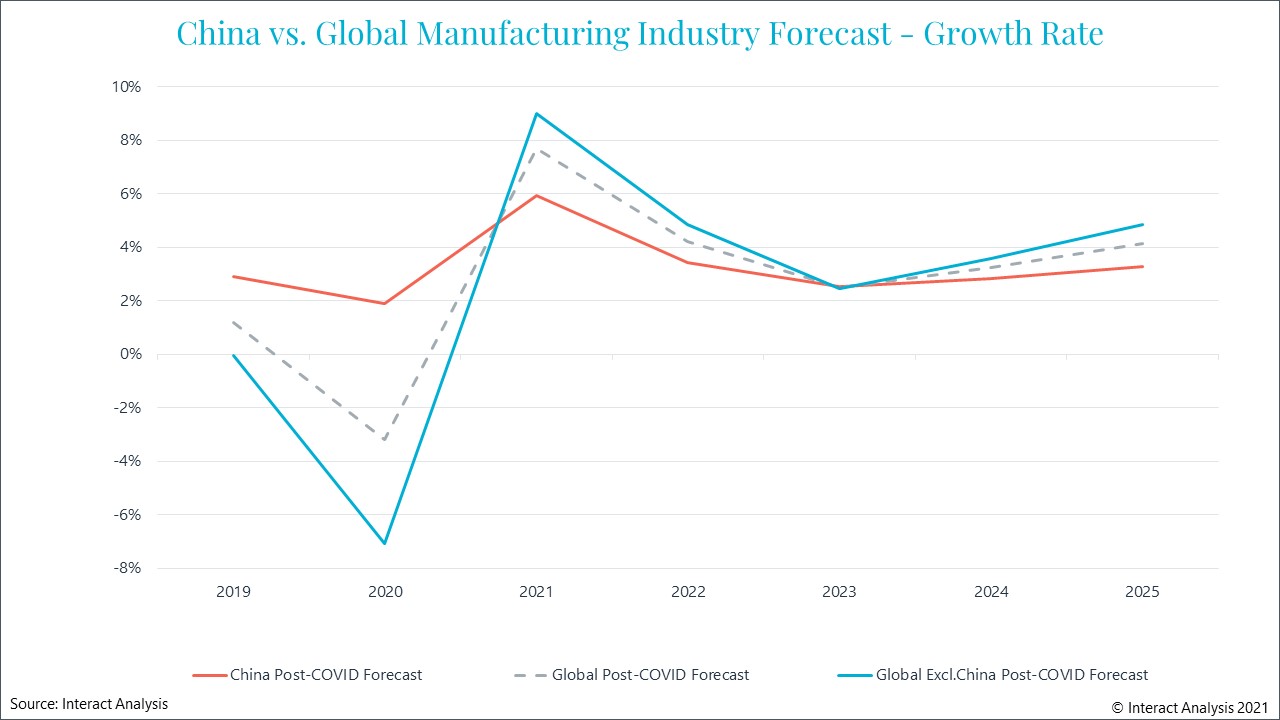

China will lose long-held status as global manufacturing pace-setter

China’s swift recovery in 2020 is having a fascinating effect on our predictions for global manufacturing out to 2025. In spite of the pandemic, the country’s manufacturing output for 2021 has been the same as we predicted before COVID-19 swept the globe and, by 2024, we expect it to be 2.3% higher than we previously predicted.

But China’s swift recovery in 2020 – even to the point of being able to report positive growth while most other regions saw growth turn negative – is going to mean that, from 2023 out to 2025, as manufacturing output in China reverts to more normal growth levels, the delayed rebound in other countries will see China lose its long-held status as the global pace-setter for manufacturing output.

China will lose its long-held status as global manufacturing pace-setter

To continue the conversation about China, or to acquire a copy of our Manufacturing Industry Output tracker, please contact Adrian directly: Adrian.Lloyd@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方