工业自动化

2021-12-13

工程机械业市场正“V”型恢复?

ADRIAN LLOYD

Adrian在技术领域具有20多年的研究和分析师团队管理经验。20多年来,Adrian一直积极参与技术市场研究,主要研究领域一直为工业自动化。他开创了众多被分析师们广泛使用的数据分析技术和方法,并创建了诸多测量框架,用于测量从工业自动化产品到半导体的众多技术市场。

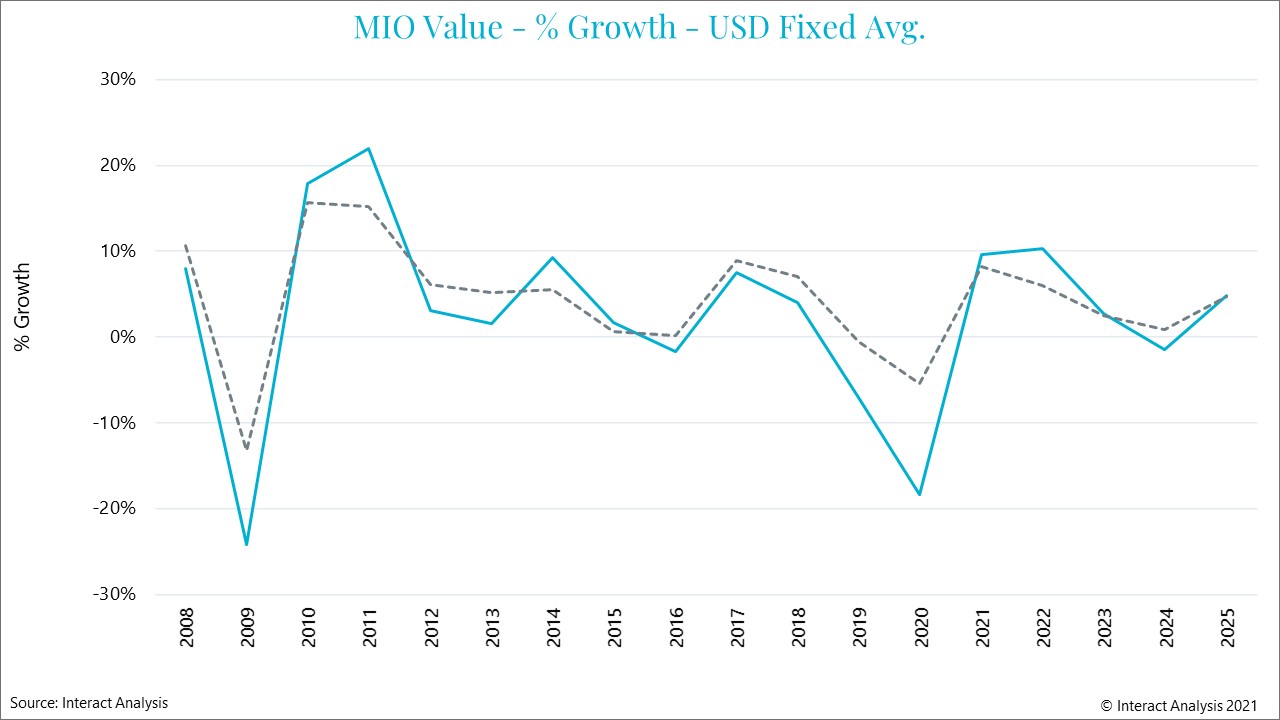

At times of economic turbulence, machinery markets get hit as consumer goods manufacturers slash spending. As we move into the post-pandemic era, the picture for machine builders is mixed. A recovery is underway. But it is likely to be a so-called square root recovery. In reality, this means a lasting slowdown that looks like an inverted square root – a huge and sudden dip, followed by a much slower and more protracted climb.

If we consider order intakes alone, the machinery recovery is a classic V-shape: end-users, having paused spending during the pandemic, are now ordering machinery in large quantities. The problem is that OEMs cannot meet this demand due to supply chain snarl-ups depriving them of vital components and semiconductors, and also due to there being simply too many orders coming in at once. The situation is ironic since, in the main, the major end-user manufacturers were able to keep producing as normal during the pandemic – only pausing planned machinery upgrades out of caution.

That said, the machinery sector is bouncing back, with farming machinery, semiconductor & electronics machinery, and textiles machinery leading the way. In this insight, we take a look at the immediate prospects of two machinery segments which had contrasting fortunes in 2020: agricultural machinery, which performed relatively well, and machine tools, which struggled badly.

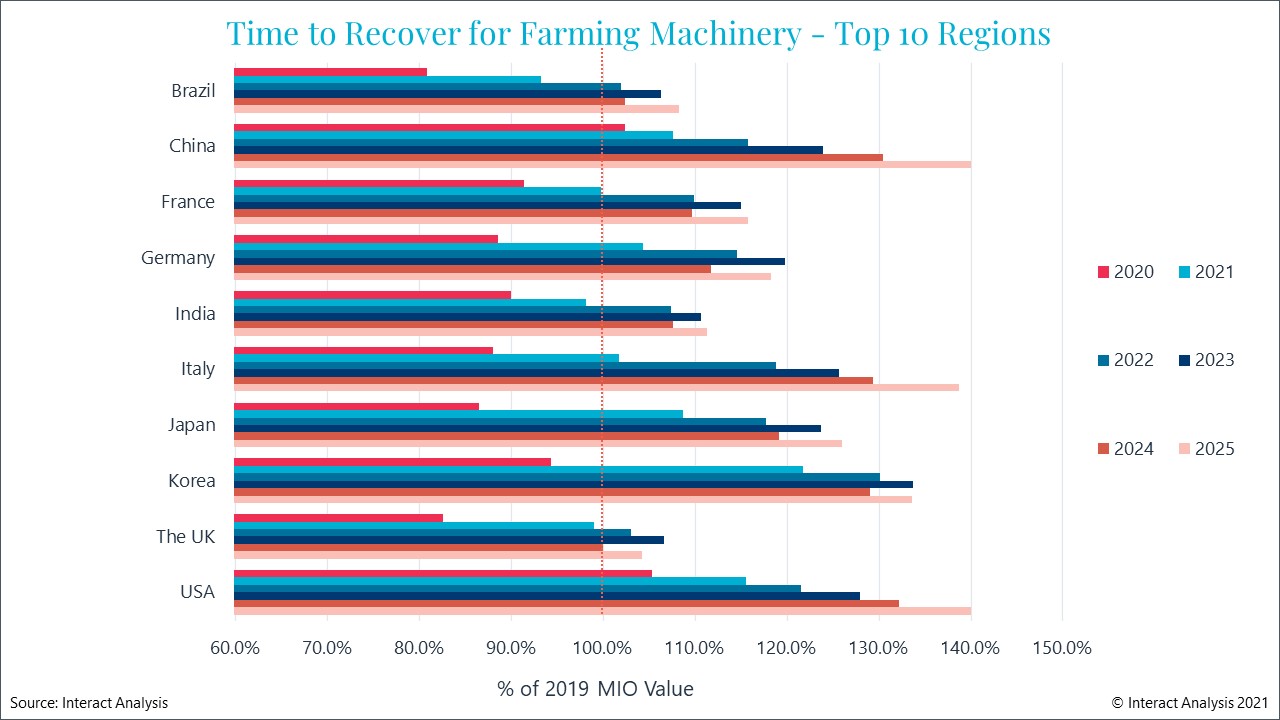

Agricultural machinery: 20% growth for Japan, other countries close behind

Agricultural machinery markets have been sluggish over the past 5 years. But the sector was one of the few to keep its head above water in 2020. Whilst many machinery segments saw slowdowns in production due to restrictions enforced because of COVID-19, farming communities worked flat out, relatively safe in the open air. People may have been locked down, but they still had to eat. And eating habits changed. There was a sharp dip in demand for food stuffs from hospitality venues such as restaurants and hotels, but the exponential increase in online shopping and the widely reported uptick in demand for fruit, vegetables, and meat from household consumers kept the agriculture sector on its toes.

In Q3 2020, CNH Industrial of the USA saw a 24% increase in sales of tractors of under 140hp. So, the farming machinery sector came out of 2020 looking strong, and a number of factors point to the short-term future being healthy as well. Firstly, crop prices are currently very high and this, coupled with high yields and low interest rates, has encouraged agriculturalists to open their wallets and invest in new equipment. Furthermore, sluggish activity in the market over the previous five years has meant that many farmers are using old machinery and are getting ready to replace or upgrade their machines. We predict overall growth in the sector to be of the order of 12.3% in 2021, with machinery manufacturers in Japan, Korea, Italy, and Germany all posting double-digit growth. Exceptional growth, in excess of 20% is forecast for Japan.

Farming machinery was one of few sectors to keep its head above water in 2020

Machine tools: bouncing back from a low base

Machine tools took a hammering in 2020, with major customers such as automotive and metals slowing down or suspending production. Contractions in excess of -30% happened in some countries. But, in 2021, reciprocal pressure has been a big driver for the machine tools industry, with countries such as Japan, Italy, Brazil and Korea seeing average month-on-month growth in excess of 15%.

Machine tools will also be one of the biggest growing sectors in France, where expansion is anticipated to be of the order of 12.5%. Though that will be outstripped by the printing machinery sector, which is projected to see a leap of 25.5% YoY in 2021. But in Germany the VDW (the German machine tool builders’ association) is revising down growth forecasts owing to supply chain problems restricting the availability of components. Whether this is global, or just endemic to Germany, remains to be seen.

Machine tools took a hammering in 2020

There’s clearly a thirst among manufacturers to start investing. So let’s hope supply chain problems resolve themselves quickly. Be aware though, that, as you can see from two of the charts above, and as we have come to expect from the cyclical nature of market demand, the heights scaled by the machinery sector in 2021 and 2022 as it revives from the shock of covid will be followed by lows in 2023 and 2024, but nowhere near what the sector experienced in 2020. Thereafter, we expect the markets to normalize.

Learn more about our Manufacturing Industry Outlook (MIO) tracker – the only complete and unified analysis of the global manufacturing industry – get in touch with Adrian today: Adrian.Lloyd@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方