工业自动化

2022-06-13

印度能否成为全球制造业中心?

ADRIAN LLOYD

Adrian在技术领域具有20多年的研究和分析师团队管理经验。20多年来,Adrian一直积极参与技术市场研究,主要研究领域一直为工业自动化。他开创了众多被分析师们广泛使用的数据分析技术和方法,并创建了诸多测量框架,用于测量从工业自动化产品到半导体的众多技术市场。

Short-term prospects: Nothing to get excited about

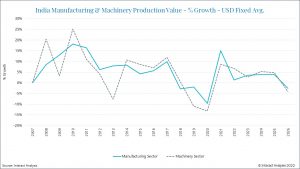

Following the turbulence caused by the pandemic in 2020, the country saw production time cut by 6 to 8 weeks and lost 16% of its production value compared with 2019. Yet India experienced a relatively strong recovery in 2021. With year-on-year growth of 13.4% taking manufacturing output to just over $1 trillion in 2021, in fact India became the global leader in manufacturing growth for that year, but much of that was reciprocal pressure as the sector recovered from the steep dip in 2020. We do not expect this recovery to extend into 2022, growth having already flattened out to less than 2% in January and February. We also don’t expect the fact that India is refusing to limit trade with Russia and is indeed in talks with Moscow to boost shipments by $2 billion will be sufficient to counteract the effect of retail inflation and rising crude oil prices caused by the Russia-Ukraine conflict.

According to the WTO, India is the second largest crude oil importer after China. So we tentatively predict single digit growth for Indian industry across 2022 with the non-metallic minerals segment expected to head the field with growth of around 6.7%, followed by electronics at 4%. Weak performance is expected for the metals industry, though we only currently have it shrinking 0.5%. But in April metal producers began cutting production and warned that plants could shut down if the region’s coal shortage continues. This could have serious implications for the country’s economy, as metals is by far India’s biggest industrial sector.

Indian manufacturing growth flattened out to less than 2% in January and February

In terms of growth in MIO value across the forecast period, i.e. up to 2026, all the indicators show that the flattening out we are already seeing in 2022 will continue through to 2025, after which we expect to see growth dip into negative numbers going into 2026.

Is China losing its appeal as the go-to region for global manufacturers?

What about speculation that the Indian manufacturing and industrial sector could in the longer term benefit from a global pivot away from China? What is this rooted in? To get an understanding of this we need first to look at the situation in China. Over the past 20 years the Chinese communist party has delivered a raft of policies to ensure market reforms supporting state and private enterprises and these have driven spectacular economic growth. But storms have gathered over the Chinese economy: we have seen geo-political conflict – notably trade wars between China and the US – impacting on the Chinese economy, and this has been exacerbated by China’s zero-covid strategy which has meant that lockdowns with their inevitable industrial slowdowns continue to persist even in 2022, disrupting international supply chains.

There have also been many serious blockages in the supply chain. For example, our manufacturing research shows that connectors, wires, plastics, and metal components, including molds, which have basically never been unavailable before, are currently out of stock at many factories. In April 2022, major connector manufacturers such as Yangtze River and HRS sent out letters to customers informing of price increases of 10-20%. Of longer-term concern, perhaps, is the government’s newly politicised approach to state capitalism. While the goals are valid – reducing inequality and debt – the means are creating waves as what The Economist describes as ‘punitive and erratic’ measures have stifled whole sectors such as the tech industry and the property sector. From a global perspective, Chinese industrial strategy is presenting a distinctly ideological face, and this is likely not attractive to inward investors, especially when COVID is already in the mix disrupting China-based supply chains.

India – Developing the domestic market is key

Could India benefit from China’s problems? Revathi Advaithi, CEO of contract manufacturer Flex, believes the region is poised to become a significant manufacturing hub due to its highly skilled workforce and relatively cheap labor. The company already has six major manufacturing facilities in India. Advaithi envisages India becoming a global player, but before that status is achieved, she says industry needs to grow and tap into the hugely lucrative domestic market. It’s a case of establishing expansive and resilient supply chains and infrastructure within the country before opening the curtains to the world stage.

She takes automotive as an example: “Cars are a great example just for the number of cars that are being manufactured in India, and what’s required in building big automotive infrastructure in India itself is pretty significant; and then taking that to a global scale and exporting them becomes a reality.” Advaithi sees establishing end-to end supply chains as the major challenge. Currently there are serious weaknesses in the production value chain caused by the fact that many components needed for the assembly of a final product are not produced locally and have to be imported into the country.

Apple builds up operations in India

India is already attracting increased international attention. Sino-American friction, coupled with serious supply chain problems in China has prompted Apple to cast its eye about with a view to moving some of the many final assembly operations it has based in China. The Wall Street Journal reports that India has become a major focus for the company, emerging as what the newspaper describes as ‘the company’s top manufacturing target in Asia, outside China’. The WSJ’s India-based correspondent Megha Mandavia, echoes Revathi Advaithi’s comments when she says that India needs to develop a stronger domestic market and better logistics infrastructure. She further adds that the country needs more export-friendly policies. Apple appears to be confident the country can deliver. India’s share of the company’s global manufacturing base is forecast to grow from 1.3% in 2021 to between 5% and 7% this year. A significant increase, and a huge vote of confidence from a global company that is highly dependent on smooth production operations.

The long road ahead

India becoming a global manufacturing hub does seem to be on the cards. After all, China did it, as have many South-East Asian countries. But Claudio Knizek of EY Parthenon advises caution. “Several of my clients in industrial sectors are looking for new sources of supply and India is typically on that list. However, many of these companies after their assessment feel that Indian infrastructure is not ready, or that strategically it’s not the right time or the right place and they end-up going somewhere else. So India needs to work on improving the conditions for companies to set up here.”

To continue the conversation about manufacturing in India, get in touch with Adrian today: Adrian.Lloyd@InteractAnalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方