机器人 & 仓储自动化

2022-03-16

自动微型配送中心市场:发展缓慢,美国领先

Rowan Stott

Rowan拥有物理学的学科背景。他支持仓储自动化部门的研究,对微履行、快速配送和末端物流有着浓厚的兴趣,并正在帮助拓展Interact Analysi在仓储领域的研究覆盖范围。Rowan运用他的专业知识和热情,深入研究这些领域的发展趋势和创新技术,为客户提供准确的市场洞察和分析。

Micro-fulfillment center (MFC) definition: a fulfillment center smaller than 50,000 sq ft, or automation within a retail store.

A change in expected demand

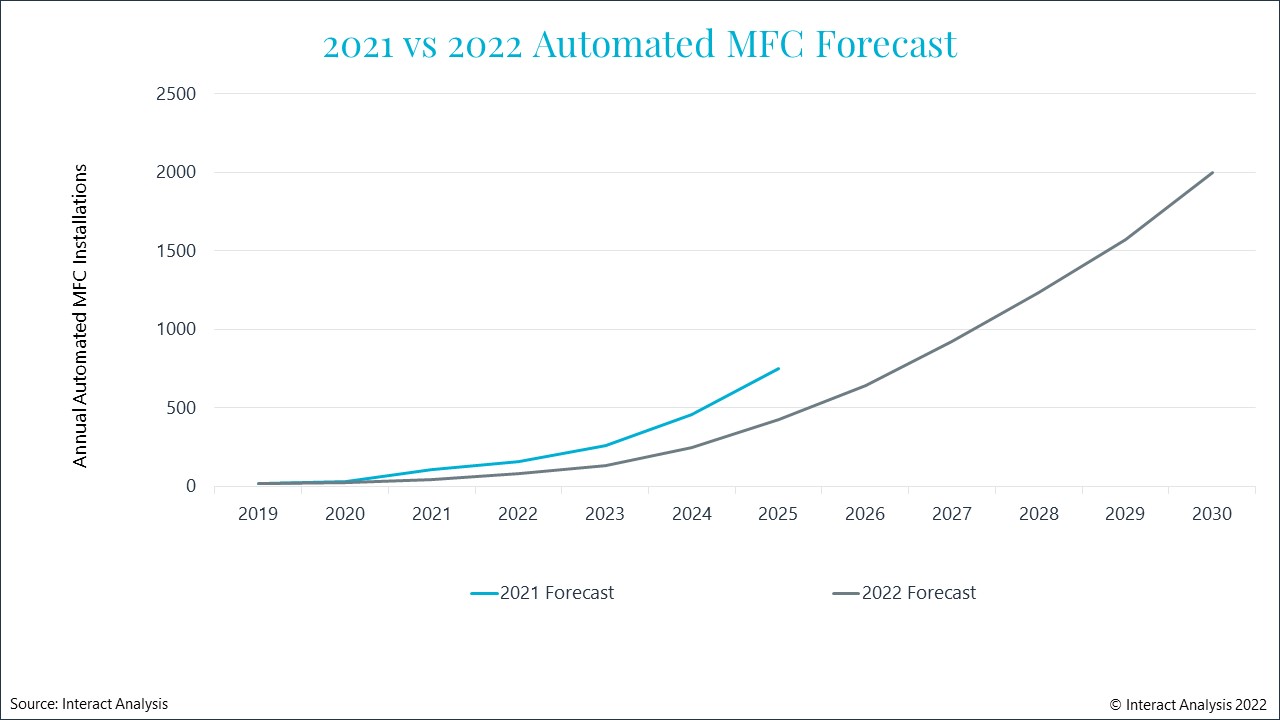

By 2030, we forecast just over 7,300 automated MFCs to be installed globally, with almost half being within the Americas. This is lower than previously expected due to a range of both supply-side and demand-side factors.

Forecast comparison from 2021 and 2022

On the supply-side, we’ve seen a much slower roll out of ordered projects than we had initially expected. Going into 2021, there was a pipeline of more than 60 ordered projects based on our vendor interviews last year. Yet the total number of projects installed in 2021 was just 43.

Almost all vendors reported fewer MFC installations in 2021 than they had expected a year prior. However, given the crippling supply-chain constraints throughout the year, it’s understandable that the number of project installations was lower than these companies had previously stated. With installations taking longer than expected, the evaluation period is also taking longer which meant that few end-users placed follow up orders in 2021.

On the demand-side, we’ve seen a little hesitancy in the market to roll out automated MFCs at scale. As part of our research for both the 2021 and 2022 edition of this report, we spoke with several grocers and the sentiment towards automated MFCs has decreased somewhat, although most cited this decline in sentiment on the basis that they’ve not seen their peers roll out MFCs at scale, resulting in a chicken & egg scenario. Another factor has been the phenomenal growth of rapid delivery companies. These VC-based online grocery retailers are on a race to the bottom to provide cheap and convenient online groceries and incumbent retailers are hesitant to join in on the race.

Comparing US and European adoption

It is important to note that adoption of automated MFCs is far higher in the US than in Europe. One reason is the US’s much sparser population: it is harder to use CFCs to deliver same-day delivery in America’s sprawling suburbs than it is to do so in the densely packed cities of France or Germany. The massive size of US stores (and car parks) compared to those in Europe is also a barrier to efficient manual picking by American rapid delivery companies – further improving the ROI of US MFCs.

One final interesting point is about delivery expectations. The US was a late-starter in grocery home delivery. In European countries such as the UK, home delivery has been going on for over a decade. Delivery times were always slower (usually more than 24hrs), and so UK customers still accept this. In the US, grocery home delivery didn’t really take off until the pandemic, when it was spearheaded by same-day companies like Instacart. Same-day delivery is therefore now the expectation of many US customers. If grocers want to compete with Instacart, they therefore need to match this – and MFCs are one good way to do it.

Threats to the industry

In response to a growing resentment of its marketplace from grocers across the US, Instacart is focusing heavily on its white-label Fulfillment-as-a-Service model. Instacart’s marketplace was eroding customer loyalty and withholding customer data. However, its white-label offering gives more power to the grocer while avoiding the need for the grocer to build out its own fulfillment capabilities. If successful, Instacart’s white label services, used by companies such as Albertson’s and Kroger’s same-day online grocery offerings, could be a potential threat to the automated MFC market as retailers switch to an asset-lite fulfillment model. That said, Instacart is building out a network of automated MFCs with Fabric to house inventory on behalf of grocers so its own investments may off-set the potentially reduced number of facilities installed by grocers.

Final Thoughts

Overall, there are positives and negatives to automated MFCs for both the grocery and non-grocery market. There is no doubt MFCs improve picking efficiency and are a good solution for same day home delivery orders. The main drawback is the cost. Instacart’s growing white-label offering and the growth of rapid delivery companies is making grocers reluctant to invest in MFCs in the short-term. However, long-term, we believe automated MFCs will be a vital cog in a profitable online grocery platform.

Within the MFC market, there are still many potential avenues to growth. To learn more about these prospects, contact Rowan today: Rowan.Stott@InteractAnalysis

最新机器人&仓储自动化洞察

2025年全球工业机器人出货量有望复苏

人形机器人核心硬件的发展现状和趋势