机器人 & 仓储自动化

2022-02-16

预计到2030年全球将有45000家 “Dark Stores”,但快速物流公司将面临新的挑战

Rueben Scriven

Rueben是全球仓储自动化行业中领先的研究分析师之一,经常在全球重要的行业活动上发表演讲,主持过多个行业研讨会。

During the last 18 months we’ve seen the monumental rise of rapid delivery companies, attracting billions of dollars of investment. Driven by the pandemic and the shift towards online grocery shopping, rapid delivery companies can deliver groceries in under 2 hours, with most claiming to be able to deliver in under 30 minutes. To achieve such fast delivery times, these companies need to store inventory in a decentralized network of dark-stores located close to the consumer.

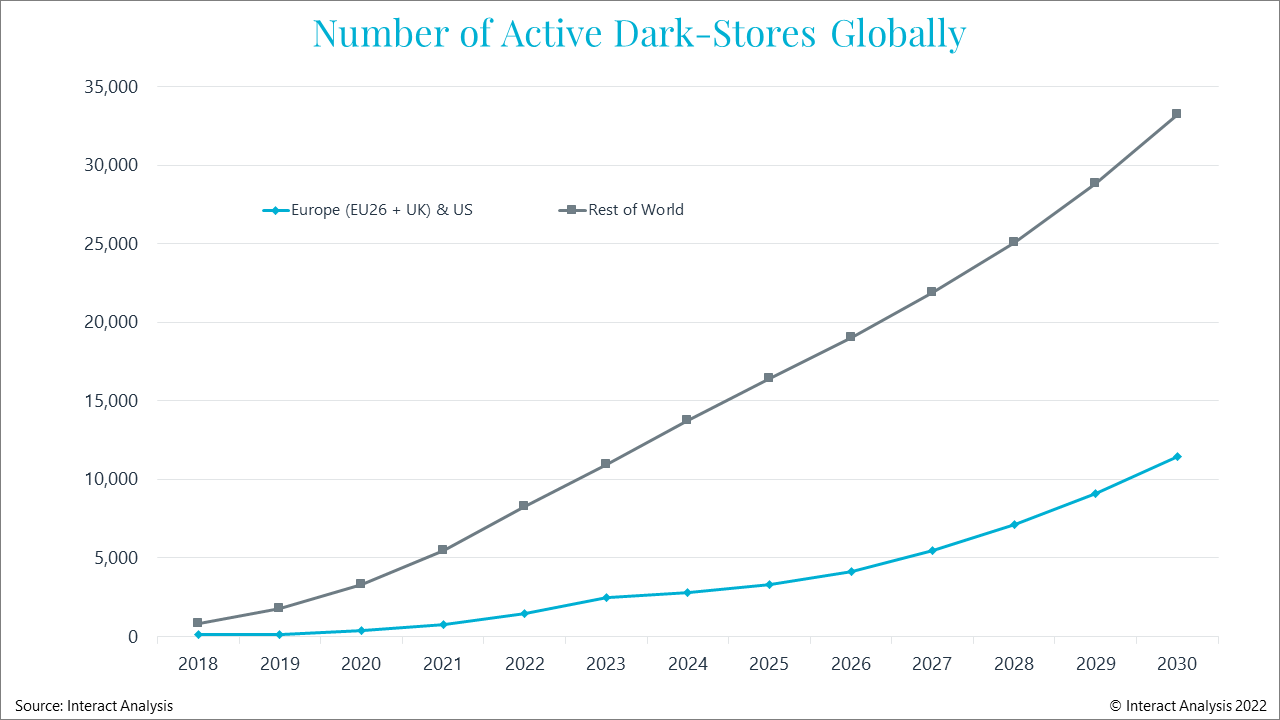

To date, we’ve tracked more than 6,000 dark-stores ‘built’ across the globe with the majority coming from Russia, Turkey and China. By 2030, we’re expecting that number to reach 45,000 globally. However, the pathway to success won’t be straight-forward – after all, this is an asset-heavy business model which can be difficult to undertake profitably, particularly with unpredictable consumer demand. Given the capital needed to be able continue to reach consumers and meet delivery expectations, we’re likely to see a period of consolidation before we see mass adoption.

Huge growth in dark-store deployments, although Europe and US will see a slowdown in 2023 – 2025

The pathway to profitability

One of the biggest challenges ahead is the pathway to profitability. There are four key levers to increase rapid-delivery companies’ profitability: 1) increase basket sizes, 2) reduce costs of goods sold , 3) reduce rent, distribution and delivery costs, and 4) increase advertising revenues. We’re already seeing several companies introduce private label brands, such as GoPuff’s ‘Basically,’ brand. Firstly, this increases product margins as private labels tend to be more profitable. Second, this could also increase advertising revenues as other brands will essentially be competing with private label products and could pay the retailers to position their products higher. Some of the larger rapid delivery companies are developing their own centralized supply chains which significantly reduces distribution costs, instead of relying on wholesalers and direct-store-delivery (DSD). Industry consolidation and increased scale will lead to a stronger purchasing power when it comes to things like rent and branded products and will also reduce delivery costs as drivers can make more deliveries per hour.

Increasing customer basket sizes has the most significant impact on profitability but will also be the hardest to achieve. In most developed economies, weekly-shop customers, which often prioritize price over convenience, tend to do their large weekly shops in supermarkets or hypermarkets rather than convenience stores due to the larger assortment and lower costs. For the same reasons, online grocery customers will likely choose their favourite brick & mortar retailer for their online weekly-shop, rather than using a rapid delivery company which has a small assortment and convenience store prices.

In Western Europe and North America, most brick & mortar retailers have reliable e-commerce sites (and platforms like Instacart) where weekly-shop customers can place large orders at a reasonable cost. Therefore, in developed economies, rapid delivery companies have to make do with convenience orders such as late-night alcohol purchases and spur-of-the-moment purchases. As a result, the average basket size for rapid delivery companies in Europe and North America tends to be very small which impacts profitability.

Developing economies, on the other hand, will likely see larger basket sizes. This is because there are fewer brick & mortar retailers with efficient, easy-to-use online platforms, and in many cases, the rapid delivery apps will be the easiest way to order online groceries. Furthermore, many consumers in developing economies are reliant on convenience stores for their weekly grocery shops. India is a great example where 78% of consumer goods are purchased from Kirana stores, a form of local convenience stores. As such, the limited assortment and higher prices (relative to supermarkets and hypermarkets) will be less of a barrier for customers to place large orders with rapid delivery companies. As a result, we expect rapid delivery companies in developing economies to achieve profitability sooner.

Choppy Waters Ahead

Given the ‘relative’ maturity of the Chinese rapid delivery market, it could provide valuable indicators to how the market might develop in Europe and North America. DingDong announced in November 2021 that its losses grew faster than its revenues, despite increasing its scale significantly to more than 1375 dark-stores (up from just 500 in 2020). This has contributed to its share price declining 88% from a high of $36 just before the announcement to a low of $4 in January. MissFresh, DingDong’s main rival in China, has also seen a 69% drop in its share price since its IPO in June 2021. However, DingDong’s Q4 earnings painted a more positive picture with its net-losses narrowing to 13% of revenue and profitability in its Shanghai operations. How investors react to this news will be worth monitoring.

Rapid delivery companies are also facing a growing slew of regulatory hurdles. Both Rotterdam and Amsterdam, for example, introduced a one-year ‘freeze’ on the development of new dark-stores due to cycling congestion. Similarly, New York Bodega’s are attempting to use zoning laws to defend against dark-stores, arguing that dark-stores are a type of warehouse and therefore cannot be built on residential land.

The issues surrounding profitability and the introduction of potential regulatory hurdles may sour investor sentiment in Europe and North America. Whilst investor sentiment isn’t a great proxy for the long-term sustainability and growth of an industry, the rapid delivery industry is highly reliant on capital for customer acquisition and network expansion, particularly as few companies have reached profitability. As a result, we may see a period of slower growth in Western countries between 2023 and 2025 unless investors continue to provide additional capital to these loss-making companies. However, in markets where online grocery is less developed we expect rapid delivery companies to continue attracting investment.

The future for rapid delivery companies

Following a period of valuation declines, we may see some industry consolidation, during which both brick & mortar retailers and well established rapid delivery companies will likely lead the acquisition spree. From the perspective of brick & mortar retailers, acquiring a rapid delivery company would lead to several hundred discounted fulfillment assets (dark-stores), along with IP for the software used to replenish dark-stores which could be rolled out to small format stores. Conversely, consolidation among rapid delivery companies would lead to better purchasing power, both in terms of supplier negotiations, as well as on rent price. This will also drive down delivery costs as drivers can deliver more orders per trip; most rapid delivery companies aim for 4.5 – 5 orders per hour.

Given the reliance on capital for network expansion and customer acquisition, we’ll likely see a short-term slowdown in the market if investors deep the ventures too risky. Long-term, however, we expect that rapid delivery companies will play a vital role in the economy, as consumers continue to expect higher levels of convenience. This will be further driven by the growth of social commerce, which is picking up momentum in China. Only last week MissFresh joined forces with ByteDance (developer of TikTok) to offer a social commerce grocery offering meaning consumers can place online rapid deliveries after watching, for example, a recipe video online. Whilst the industry will likely experience growing pains over the coming years, we believe this industry will be poised for long-term growth.

To learn more about rapid delivery companies, get in touch with Rueben Scriven today: Rueben.Scriven@InteractAnalysis.com

最新机器人&仓储自动化洞察

2025年全球工业机器人出货量有望复苏

人形机器人核心硬件的发展现状和趋势