商用车

2022-03-04

俄乌冲突是否将恶化2022年的农机设备市场?

ALASTAIR HAYFIELD

Alastair在规模化、高增长的工业和技术市场领域拥有超过15年的领导研究项目经验。作为商用车辆部门的高级研究总监,他负责电动卡车和公交车、自动驾驶和非道路设备电动化领域的前沿研究。

It’s been a little over one week since Russia invaded Ukraine. Whilst the conflict is in its infancy, the response from the international community has been swift, with unprecedented economic sanctions levelled against the Russian state. Already the consequences of the conflict and the sanctions are being felt in Russia and globally – oil and commodity prices are on the rise, the Russian economy is on the slide, and manufacturers and brands are pulling out of or ceasing sales and production in Russia. For the agricultural equipment market there are already some signs that there will be an impact on sales in 2022, with the possibility that a sustained conflict will cause a longer dip into 2023.

Oil Price Surge

The price of Brent Crude oil has been on the rise for some time since a drop at the start of the Covid-19 pandemic. Moving from $25 per barrel in the spring of 2020, it had reached almost $90 per barrel before the Russian invasion of Ukraine. Since the invasion it has spiked to $115 per barrel and looks set to continue to rise well beyond this in the near term.

Whilst a long-term prognosis on oil prices is difficult in a period of uncertainty, high oil costs typically have a number of knock-on effects for the agricultural equipment market:

– Higher input costs for farmers: increasing fuel costs and fertilizer costs will impact farm income. Farm income is directly correlated to the spend on new machinery and suppressed farm income will likely put some buyers off.

– Well documented supply chain constraints have already pushed commodity prices upwards – like steel and aluminum. Rising oil prices and sanctions against Russia will push commodity prices higher too, forcing ag equipment manufacturers into a difficult position of having to increase prices again (already, earlier in February, John Deere increased prices by roughly 8%). Higher equipment prices may also dissuade some buyers.

It will likely take a quarter or two to assess the impact on sales, but it would not be surprising to see tractor sales start to slide in major markets, particularly as 2020 and 2021 were such strong years (driven by high crop prices and pent-up replacement demand). Perhaps the one glimmer of hope is that, despite rising interest rates, they are historically low, so the finance of new machinery should still be achievable for many.

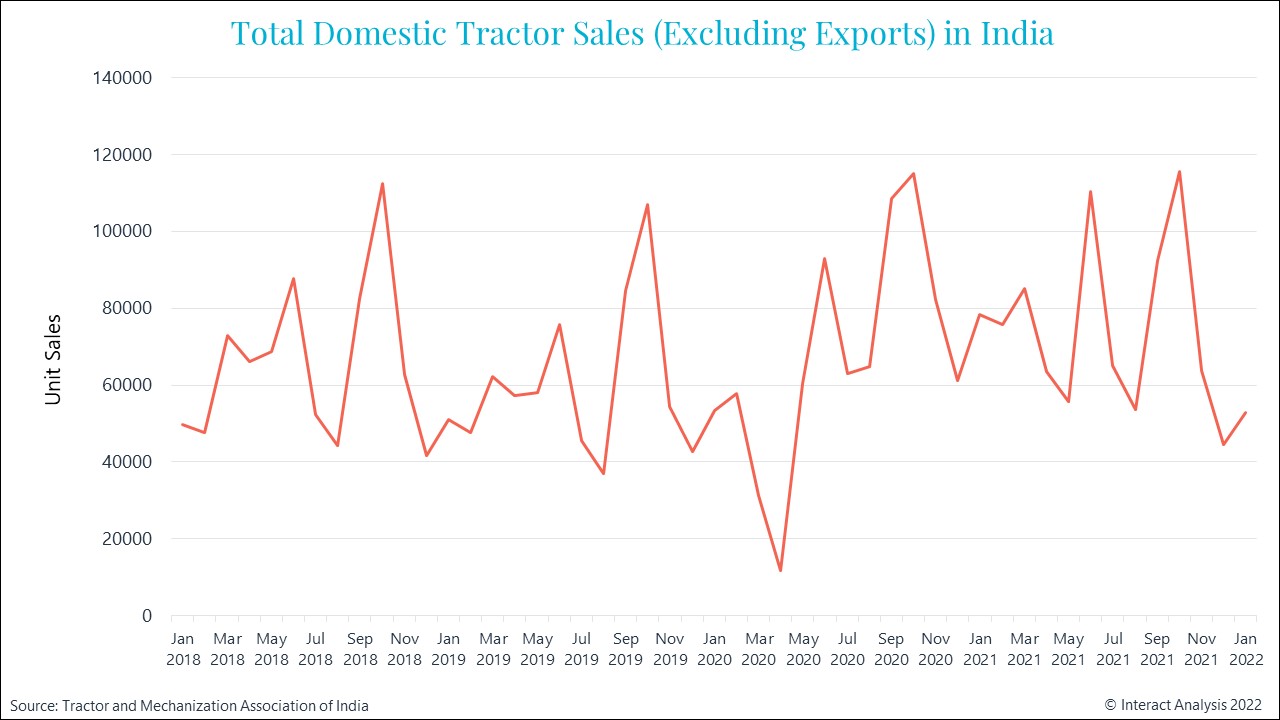

India, in particular, is heavily reliant on fertilizer supplies from Russia to support its vast agricultural market. Reports are already emerging that it is proactively looking at ways to settle payments with Russia in rupees to lessen the impact of sanctions. The Indian tractor market has continued to grow extraordinarily well in recent years, despite covid-19. However, a slow start to 2022 and higher input costs and scarcity of fertilizer might provide enough headwind to see it decline in 2022.

After a few years of good growth for the Indian tractor market, 2022 has seen a slow start with future growth not looking promising

Impact on the Russia Agricultural Equipment Market

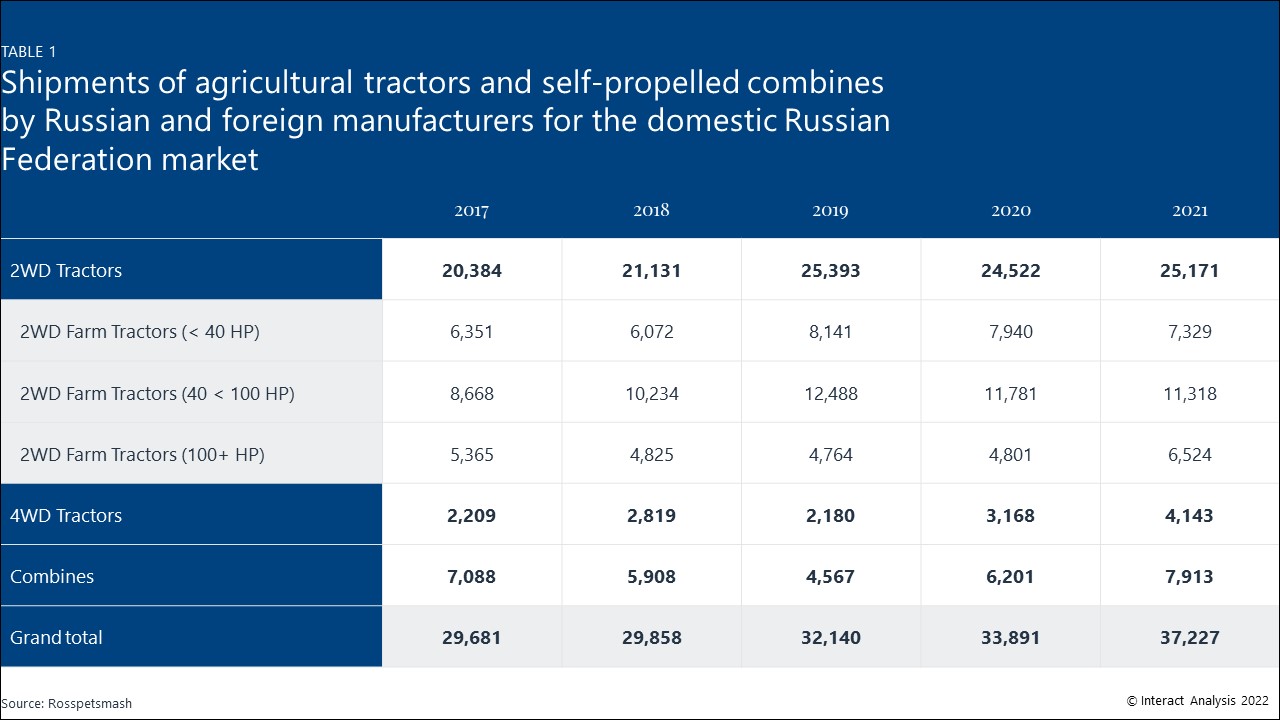

The Russian market for tractors and combines has moved from annual sales of 30,000 units in 2017 to annual sales exceeding 37,000 units per year in 2021. Russia also increased exports of agricultural machinery and equipment by nearly 40% in 2021

Russian market for tractors has risen during 2017 to 2021 but likely to be impacted due to current events

Exports are likely to be impacted, particularly as Russian manufacturers supply into Europe. Whether they collapse entirely will be dictated by how much Russian manufacturers can target sales into China and other markets that have taken a less severe stance on sanctions.

Domestic sales may be impacted because either demand for imported models cannot be met or economic conditions within Russia collapse to such a point that demand for new agricultural equipment dries up. Furthermore, economic sanctions against Russian financial institutions may impact the finances of both manufacturers and those looking to finance the purchase of new machinery.

Crop Prices and Ukraine the Breadbasket of Europe

Ukraine has, historically, been described as the “breadbasket of Europe”, accounting for sizeable global production of wheat, corn and barley. The Ukraine conflict has caused a panic in global food crop markets, with prices for wheat sky-rocketing in recent days.

Higher crop prices are a positive for farmers because they will push up farm income. However, the impact of rising tractor prices and rising fuel/fertilizer costs will likely wipe out any significant benefit. It is also unclear how long a price spike will last. Although wheat exports from Ukraine will be impacted, several years of poor crop performance there have meant that the global market can make up for the loss (in Australia, for example).

What are Manufacturers Doing?

It’s very early to tell exactly what manufacturers will do with regard to Russia in the long term. Cummins and John Deere have stated that they will (obviously) abide with sanctions but there will be an impact on their businesses, particularly if they shutter production or stop sales. Financial sanctions on Russian banks will also make it more difficult for money to enter/exit Russia, which may make it problematic for some business to continue operations there. If the conflict continues for a long time – 2 or 3 years or more – there is some potential for organizations to review their business in Russia altogether.

An Opportunity to Focus on Efficiency

Despite the immense negativity of any armed conflict, there is an opportunity for agricultural equipment manufacturers to focus on new efficiency innovations. Technologies that can reduce the use of fertilizers, fuel and tractor materials will help to offset the impact of rising oil prices. We expect there to be renewed interest in tractor hybridization and diesel replacement. Furthermore, those tractor vendors with a focus on smart solutions – like precision agriculture – that reduce the consumption of fertilizer will also likely make gains in the next 2 or 3 years.

To continue the conversation about the agricultural machinery sector, contact Alastair directly on alastair.hayfield@interactanalysis.com

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口