商用车

2021-11-29

3种新商业模式将推进叉车市场电动化

MAYA XIAO

Maya在电动汽车、自动化系统和机器人领域拥有跨学科的技术背景,现担任Interact Analysis的研究经理,负责锂离子电池、叉车、工业和协作机器人市场等研究。

Of all categories of off-highway vehicles, forklifts have made the largest strides toward electrification. That’s because the way forklifts are used makes them relatively easy to electrify. But to hit net zero companies have to do more than just electrify a large part of their forklift fleets: they have to electrify their entire fleets. And they have to contend also with a demand from users of lead-acid battery powered forklifts to shift over to Li-ion powered models because of the comparative benefits Li-ion battery offers. The problem is the price of Li-ion batteries. To make Li tech affordable for all forklift users, new business models are crucial.

Our electrified off-highway powertrain pricing research showed that the battery pack prices for off-highway are far higher than for on-highway vehicles. The reasons for this are simple. Firstly, it’s a matter of scale. Electrified off-highway equipment simply cannot match the scale of production of its on-highway counterparts as numbers of vehicles are so much smaller, and the range of applications is so much wider. Secondly, off-highway equipment commonly requires non-standard specialized battery packaging, often irregularly shaped to fit into specific machinery, and sometimes protectively packed to withstand harsh operating environments.

These issues affect the Li-ion forklift truck market, but the good news is we are seeing the penetration rate of Li-ion battery technology increase in the smaller class 3 truck market, as the battery pack is already an off the shelf product. An average 5% year-on-year decline in battery prices for forklifts is forecast up to 2030, but what can be done to speed up electrification of larger forklift truck classes? Technological innovations are crucial, but new business models also have an important role to play.

Batteries-as-a-Service?

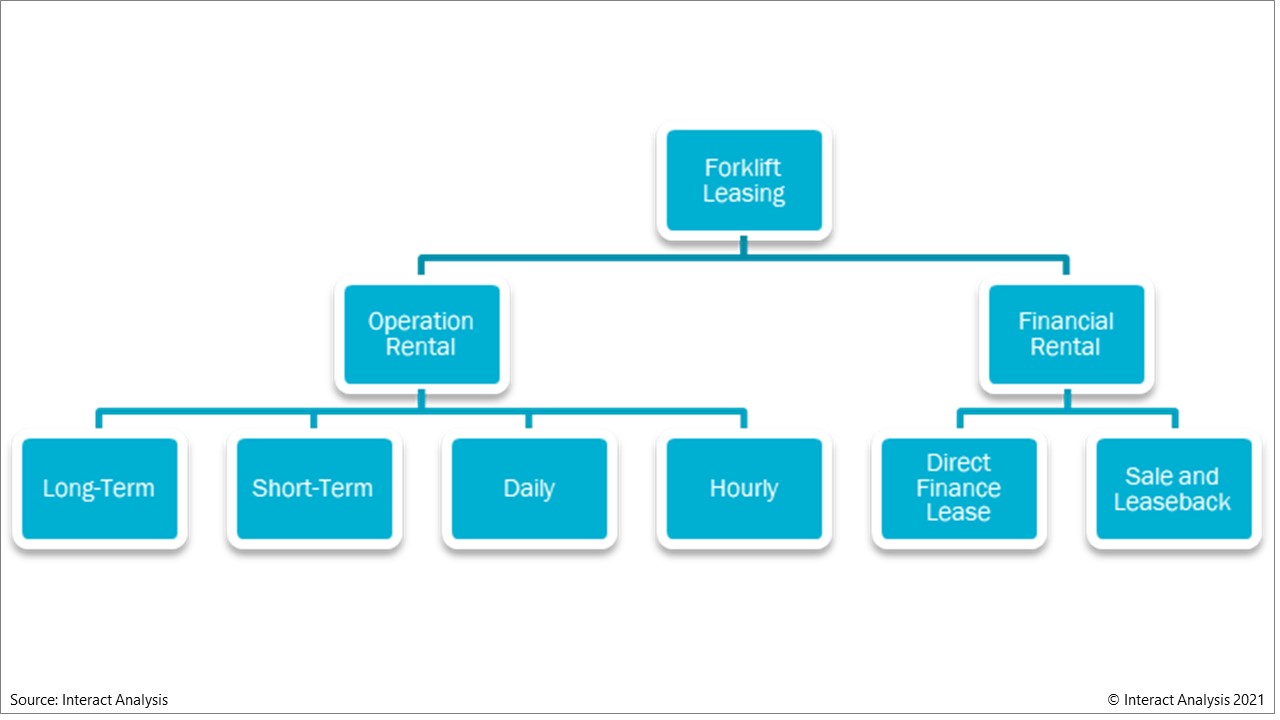

One way round the high upfront costs of Li-ion batteries is a battery leasing model. This could also be described as a Batteries-as-a-Service model, since customers are essentially paying a monthly fee for access to a battery. As well as removing the initial barrier of a high purchase price, battery leasing also removes concerns about the decline in battery life over time, since the battery leaser is under contract to provide a battery that is fit for purpose, and therefore will replace it at no extra cost to the user when needed. The diagram below summarises a range of leasing models that are used by forklift manufacturers.

Existing forklift leasing models can easily be repurposed to offer battery leasing options

Retrofitting

Lead-acid to Li-ion

Certain classes of forklift have been powered by lead-acid batteries for decades. But these batteries are bulky and have low power density compared to Li-ion batteries. Lead-acid forklift manufacturers are facing demand from existing customers who want to refit existing machines with Li-ion batteries, which are much cleaner, charge faster, and do not have to be removed for charging. Battery substitution is relatively easy from a technical perspective. That’s because the 80V platform on a lead-acid forklift, as well as the frame and hydraulic parts, are compatible with Li-ion technology.

But battery pricing continues to be the pinch-point, as the cost of replacing a lead-acid battery with an Li-ion battery represents 40%-70% of total forklift cost. Nevertheless, this business model has been seized by traditional lead-acid forklift manufacturers, such as SAFT, FAAM and TIANENG, who are keen to quickly grow their share of the Li-ion forklift market.

Diesel to electric: an attractive stop-gap

Diesel forklift manufacturers are also looking for a piece of the action in the new energy market. They are breaking into it not by producing state-of-the-art electric forklifts, with all the costs that that would entail, but simply by taking existing diesel machine designs and replacing the drivetrain. While this solution does not carry the same technical advantages as purpose-built electric platforms, it is a cost-effective stage on the journey to pure electrification.

TEU and JAC Forklifts are examples of companies following this path, and both companies are employing external suppliers to provide complete diesel-to-electric technical solutions. The diesel retrofit market has high potential. To take China as an example, 3,000 diesel to electric machines were sold in 2020, and the total stock of diesel forklifts in the country is over three million.

Partnerships with automotive

Another strategy for new energy forklift manufacturers seeking to make their products price-competitive is to partner up with on-road vehicle manufacturers, who are much better placed to get production costs down through economies of scale. The automotive and heavy-duty vehicle sectors are both making rapid progress at mass-producing more powerful batteries. Such batteries can easily be applied to forklifts with a simple tweaking of the design of the machine platform.

This would allow forklift manufacturers to buy batteries off the shelf from automotive manufacturers at highly competitive prices. Another solution is purchasing second-life batteries from the automotive sector – Audi has deployed second life batteries into forklifts at its factories and Nissan have partnered with 4R Energy to do the same. We have spoken to companies considering this strategy and have been told that even if they have only 50% of the performance capability of new batteries, they could still be an extremely cost-effective solution in the material handling sector.

To learn more, get in touch with Maya Xiao direct: Maya.Xiao@InteractAnalysis.com

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口