商用车

2021-11-09

2028年全球叉车出货量预测提高40%

MAYA XIAO

Maya在电动汽车、自动化系统和机器人领域拥有跨学科的技术背景,现担任Interact Analysis的研究经理,负责锂离子电池、叉车、工业和协作机器人市场等研究。

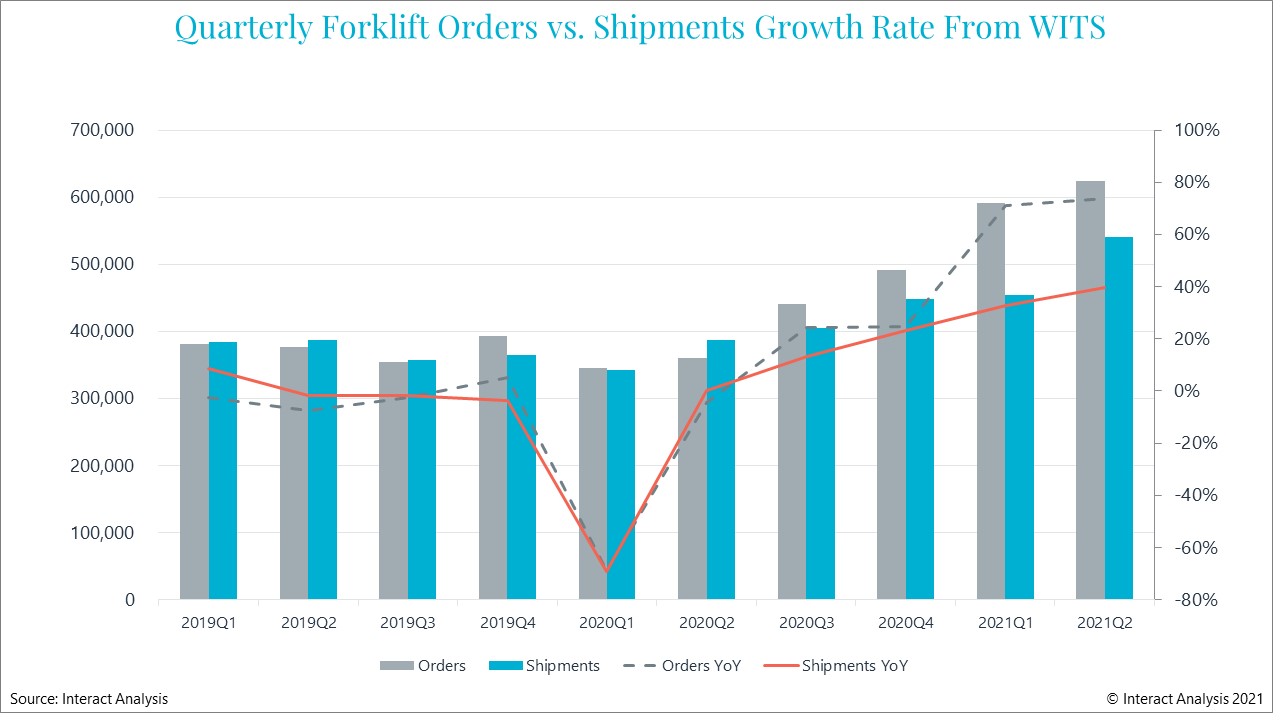

Prior to 2019 the global forklift market had been underperforming for a significant period. Things got worse in early 2019 as fears of a recession caused companies to hold back planned investments in new materials handling equipment. By Q4 2019, an uptick in orders was visible, but then the pandemic hit and Q1 2020 saw a drop in orders of nearly 70% year-on-year.

However, as the pandemic drove e-commerce to hitherto unseen levels, there was a sharp rebound in order-intake, especially in China. Like many industries forklift manufacturers then suffered from the problem of being unable to ship large numbers of orders due to supply chain blockages.

As the pandemic drove e-commerce to unseen levels, there was sharp growth in forklift orders

High growth in first half of 2021 will be balanced by a slower second half

The gap between orders and shipments has widened during 2021 owing to the shortage of raw materials (notably steel) and rapid increases in logistics pricing, especially in shipping, which have seen the cost of a single container rising by as much as 500%. On top of that, labor shortages and energy supply problems continue to hold back production. As the graph above shows, 2021 shipment growth is about half that of order growth.

Growth in order intake is being driven by problems caused by enforced social-distancing and staff-absence in factories and warehouses during the pandemic. This, coupled with the growth in e-commerce logistics and large numbers of unfilled vacancies, has accelerated a shift towards automation as companies strive to future-proof their enterprises and make them more flexible to respond to sudden changes in demand.

China has, unsurprisingly, led the market – taking in orders for 590,000 units in the first quarter of 2021. The volume of orders in those first 3 months was equal to the volume in the first 4.5 months in 2020. But in the second half of the year, we’ll see a significant slowing in growth due to the global supply chain problems. Ultimately, overall growth for the year will balance out to around 30%. CAGR between 2021 and 2030 will be 6.1% globally, with worldwide annual sales of forklifts exceeding 3.4 million units by 2030.

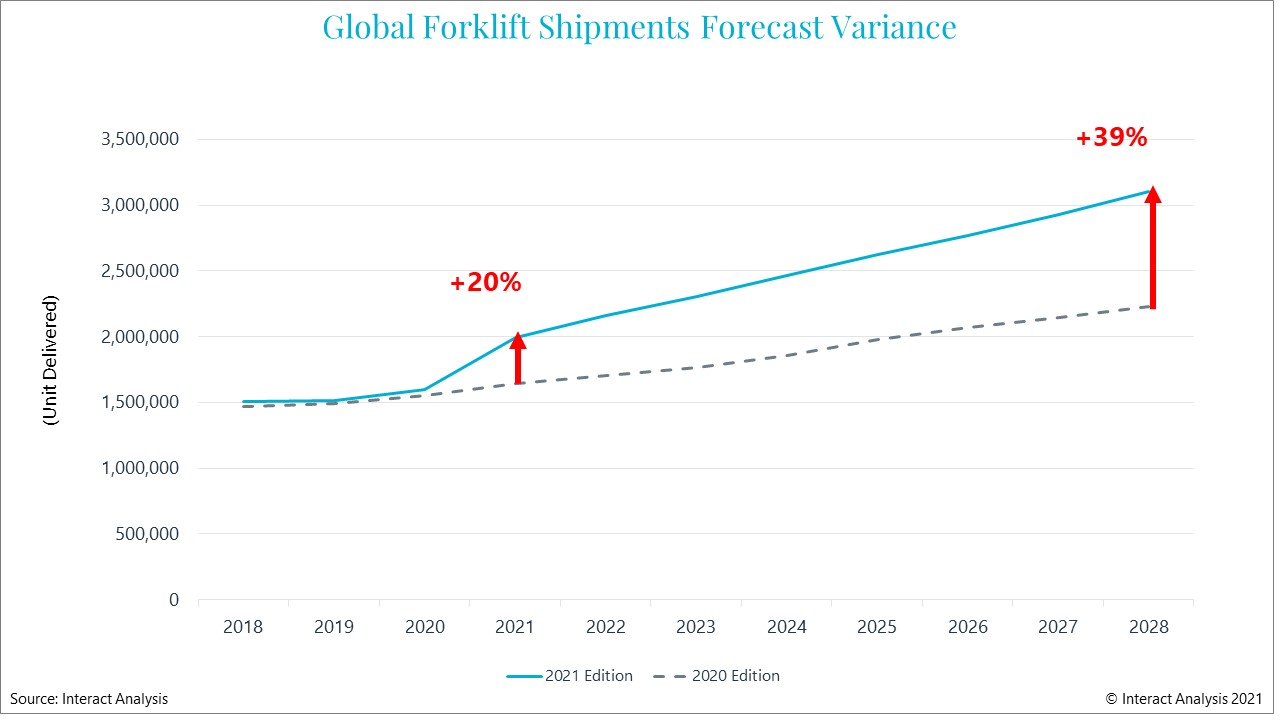

Shipment forecasts for 2028 are ~40% higher than 2020 edition

In general, our prognosis for the forklift market is much more positive than previously assumed. Our 2021 shipment forecast is 20% higher than our 2020 forecast, while our forecasts for 2028 are 39% higher. To some extent, the sharp rebound in 2021 has raised the growth base across the whole of the next decade. Much of this is due to the increased determination, prevalent in the manufacturing and logistics sectors, to invest in automation solutions as a result of their experiences during the pandemic.

Shipment forecasts for 2028 are around 40% higher than 2020 edition

Clean energy a spur to growth

We haven’t mentioned clean energy yet, but it’s going to have a significant effect on the forklift market. Indeed, to a large extent it already has, as lead-acid electric forklifts have been widely used for many years. But the boom in electrification in the automotive sector, and the coming-of-age of the Li battery, heralds a new dawn for the forklift truck industry, at a time when demand for safe, quiet, clean, and smart indoor warehouse and factory forklift solutions, including autonomous equipment, is increasing.

And all this is happening against the backdrop of a relentless drive by governments, nationally and locally, towards greener, more environmentally friendly industrial policies. We’ll be looking at business models for forklift electrification in a later insight, but more and more forklift suppliers are building up their electric forklift offerings, both lithium-ion and fuel-cell powered.

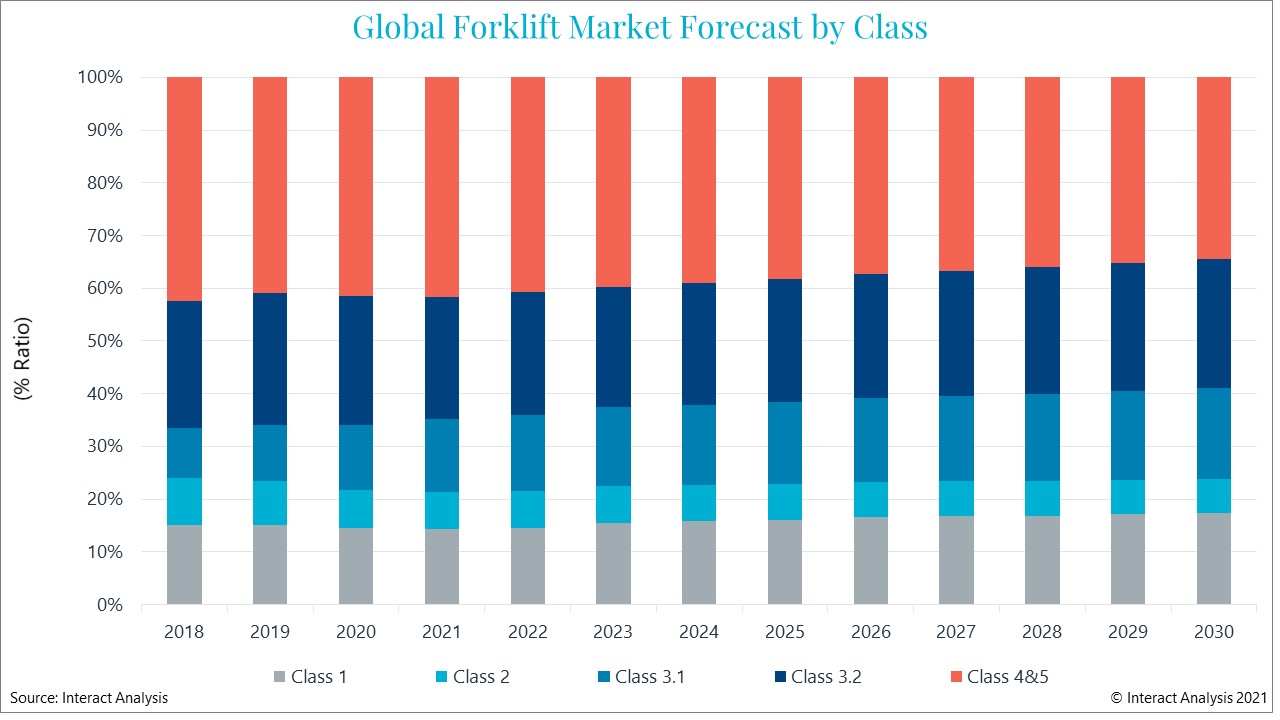

48% percent market share for warehouse forklifts by 2030

Warehouse forklifts are the main drivers of the market (classes 2, 3.1 and 3.2 in the chart below). And we predict their market share will rise from 44% in 2021 to 48% in 2030.

Light-duty forklift applications for warehouses (classes 2, 3.1 and 3.2) are driving the market

From a regional perspective, in terms of shipments, APAC is in the driving seat, driven by China, Japan, and South Korea. The APAC region accounts for 51% of 2021 shipments globally, a share that is expected to rise to nearly 60% by 2030.

To learn more about the forklift market, and about our upcoming forklift research, get in touch with Maya directly: Maya.Xiao@InteractAnalysis.com

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口