商用车

2022-08-03

电动化趋势推动非道路设备用移动液压系统市场的技术复兴

Brianna Jackson

Brianna拥有生物学和化学学科背景,她对可持续发展和医疗技术有着浓厚的兴趣,为IA团队在这些领域的专业知识增添了更深层次的洞察和见解。

As vehicle electrification accelerates, the role of the hydraulic system is being more closely examined. Battery life is paramount in electrified architectures and hydraulics have traditionally been an energy taxing technology. Improvements in the hydraulic system is therefore key to enabling a longer battery life for electrified vehicles. In this context, one might say a renaissance within hydraulic technology is underway.

So far, vehicle OEMs have explored a variety of solutions aimed at improving the efficiency of their vehicles. Within hydraulics, these changes range from incorporating novel technology to redesigning the entire system. Through trialing these new components and systems, one thing is crystal clear: improving vehicle efficiency through the hydraulic system will not be a one size fits all solution. Factors such as vehicle size, operating conditions, duty cycle, and the degree of control an application requires, determines the viability of the solution in question. As vehicle OEMs strive to achieve their electrification ambitions, these factors must be kept in mind as the balance between efficiency and practicality is struck.

In this insight, we have outlined the challenge traditional hydraulic architectures are facing in the wake of electrified off-highway vehicles and the pros and cons of emerging hydraulic technologies within this context.

Why Must the Status Quo Change?

The advantage of traditional hydraulic systems has always been their ability to achieve unmatched power density at very low costs. From a vehicle OEM perspective, this benefit was so great that the efficiencies in the hydraulic system became an afterthought. While vehicle OEMs are not quick to eliminate or even alter this tried-and-true technology from their designs, a fact is becoming clear: the hydraulic system will need a significant boost in energy efficiency to accommodate electrification.

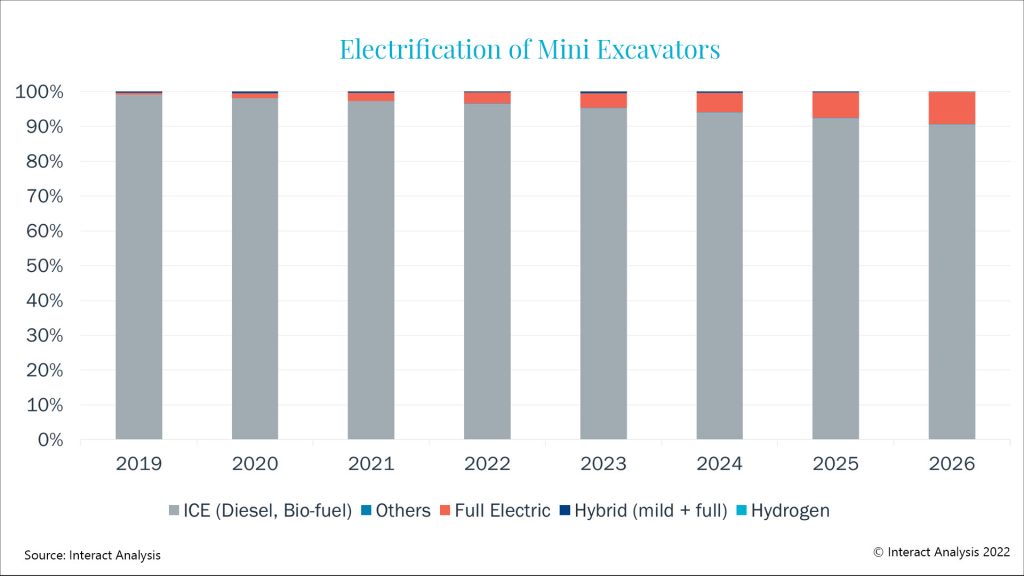

Some vehicle OEMs have begun to electrify certain portions of their portfolios and have made significant progress in evaluating hydraulic system redesigns. One example where electrification is beginning to emerge is in electric mini excavators. We estimate the market for hydraulics sold to this vehicle type to be approximately $1.6bn in 2021. Given the size, these vehicles will be a fertile testing ground for new hydraulic technology. The rate at which mini excavators are going electric is shown below.

Hydraulics – Electrification of mini excavators

Electromechanical Actuators: What they lack in power-density they make up for in other ways

Earlier in the year, Bobcat unveiled their electric compact track loader, the T7X. The electric track loader was brought to life as a result of a collaboration with Moog Construction. Aside from its electric powertrain, one of the vehicle’s most interesting design features is the replacement of hydraulic cylinders with ball screw mechanical actuators. As mentioned above, electromechanical actuators provide an advantage in terms of maintenance in comparison to their hydraulic counterparts. The most pressing constraint of replacing hydraulic cylinders however, is a loss of power density. Though, in applications with low power density requirements, electromechanical actuation offers benefits such as tighter control and less noise. Additionally, within an electrified vehicle, the removal of the hydraulic system can simplify the overall design.

In our most recent insight, we outlined that the best use cases for replacing hydraulic cylinders with electromechanical actuators. These use cases included vehicles found within the material handling sector such as aerial work platforms and telehandlers. However, the construction sector might also see greater adoption of electromechanical actuators. In the right applications, replacing hydraulic actuation with electromechanical actuation can lead to a lower total cost of ownership (TCO) as result of fuel savings, reduced maintenance costs, and tax subsidies associated with implementing green technology.

Digital Hydraulics: A step change in efficiency

Digital hydraulics has been a topic of much discussion for years. Digital hydraulics gets its name from the fast switching on/off valves used in the technology. This technology tends to carry significantly higher efficiencies when used in place of traditional hydraulic components. Over the past few years, we have seen a variety of digital hydraulic solutions released on the market.

In late 2020, Volvo announced a partnership with Norrhydro to produce an electric excavator. Norrhydro’s proprietary technology, the NorrDigi system, features a multichambered digital hydraulic actuator. This modular system reduces the bill of materials significantly by eliminating the main control valve and shortening the length of hosing required. The higher efficiencies brought by the digital hydraulic system also supports a longer battery life which is key to making electric excavators a practical solution.

Another example in the digital hydraulic space is Danfoss’s widely discussed Digital Displacement Pump (DDP). This pump has been shown to increase fuel efficiency by 30% in ICE-powered vehicles. While market sentiments on the DDP are still developing, the technology is promising as a successor to traditional hydraulics and Danfoss has cemented itself as an early mover in the digital hydraulic space.

Digital hydraulics offer enhanced efficiencies while largely maintaining traditional hydraulic architectures. For this reason, we believe the technology has staying power in the mobile hydraulic space. By maintaining traditional architectures, many of the drawbacks faced by other solutions such as electromechanical actuators, are avoided. We expect to see more digital hydraulic technologies introduced as the off-highway vehicle market progresses towards electrification.

Electro-hydraulic Actuation: Decoupling the working functions from the rest of the vehicle

Electro-hydraulic actuation involves each actuator being driven by its own dedicated pump and motor. This reduces throttling losses from valves and the modular nature of the technology simplifies machine maintenance in many cases. Additionally, the separation of the drivetrain from the working functions simplifies machine design when going electric. One example of an electro-hydraulic actuator is Bucher’s HELAX system. According to Bucher, the system is significantly more efficient than traditionally actuated systems. One way it achieves this higher efficiency is through an energy recouperation process. Where in traditional hydraulic systems an accumulator would be needed, HELAX offers the ability to regenerate power back into to the battery through the electric motors which drive the system.

The main drawback to electro-hydraulic solutions is the increased upfront costs which can be several orders of magnitude higher than traditional hydraulic actuation. However, for the long-term TCO, higher efficiencies could significantly reduce the total operating costs. For this reason, electro-hydraulic architectures are continuing to gain interest from many vehicle OEMs as a means to electrify.

Final Thoughts

Electrification has undoubtedly shaken up the mature mobile hydraulics market. Though no one way forward is clear, it is readily apparent that a one size fits all solution to optimize vehicle efficiency does not exist. The variety of vehicles, applications, and requirements within the off-highway market will continue to challenge mobile hydraulic suppliers. However, this will also offer suppliers opportunity to innovate as vehicle OEMs race to electrify their fleets.

To learn more about electrification, please check out our off-highway vehicle market or our mobile hydraulics market report.

For more information, contact Brianna Jackson, author of the report: Mobile Hydraulics