商用车

2022-03-28

城市公交车引领中国新能源商用车市场增长

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

China is a world leader for new energy vehicles (NEVs). China EV 100, a think tank, is forecasting NEV passenger car sales to rise to 5 million by 2023, and as high as 20 million by 2030. And this is despite the ending of government purchase subsidies in 2023. Electrification of commercial vehicles in China is following in the wake of cars. But in the commercial vehicle (i.e. trucks and buses) sector, much depends on the application and its associated practicalities. Some types of commercial vehicle – such as city buses – are well suited to NEV technology, while for others, there are barriers that will take time to overcome.

China’s NEV bus fleet tops 700,000

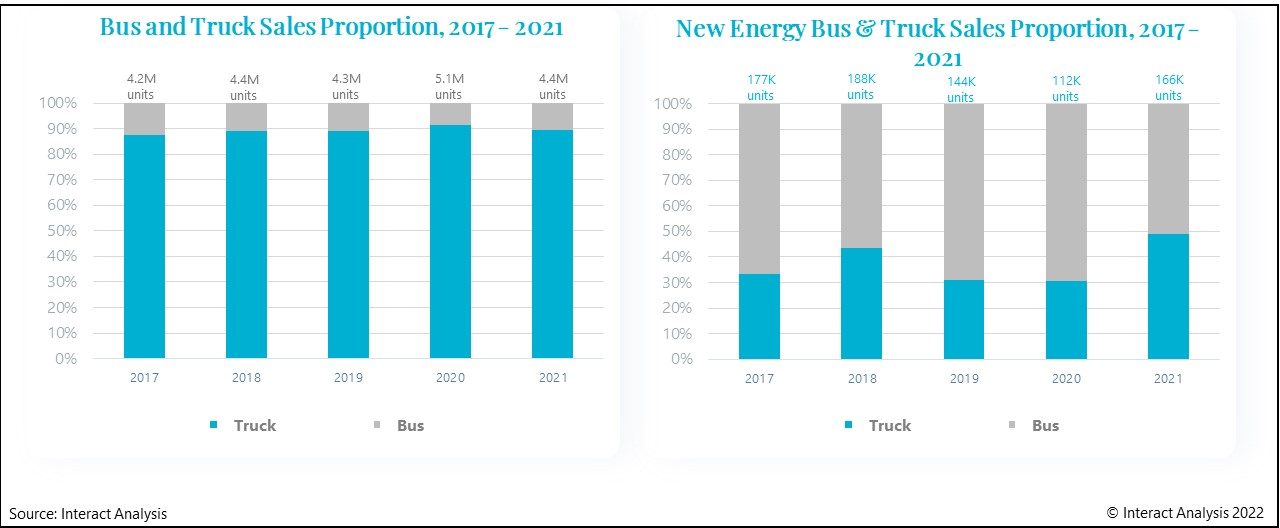

NEV buses are way out in front as compared to trucks, and strong investment has been heavily stimulated by the pilot ‘10 cities – 1,000 units’ program – which is a set of preferential tax and subsidy policies. Passenger bus sales represent only 10% of overall sales of commercial vehicles but, when it comes to sales of new energy vehicles, buses represent 60% of total sales. In fact, in 2020, more than 98% of urban public transport vehicles sold in China were new energy vehicles.

City buses are the main driver of all this. That’s because their operating characteristics – fixed routes and limited daily mileage (usually no more than 200 km) – make them prime candidates for electrification. In contrast, the electrification of intercity buses presents much larger challenges in terms of range, infrastructure and charging times.

In terms of overall unit numbers, NEV truck and bus sales in China were almost equal in 2021, but buses make up only about 10% of total truck and bus sales

NEV truck penetration is tiny

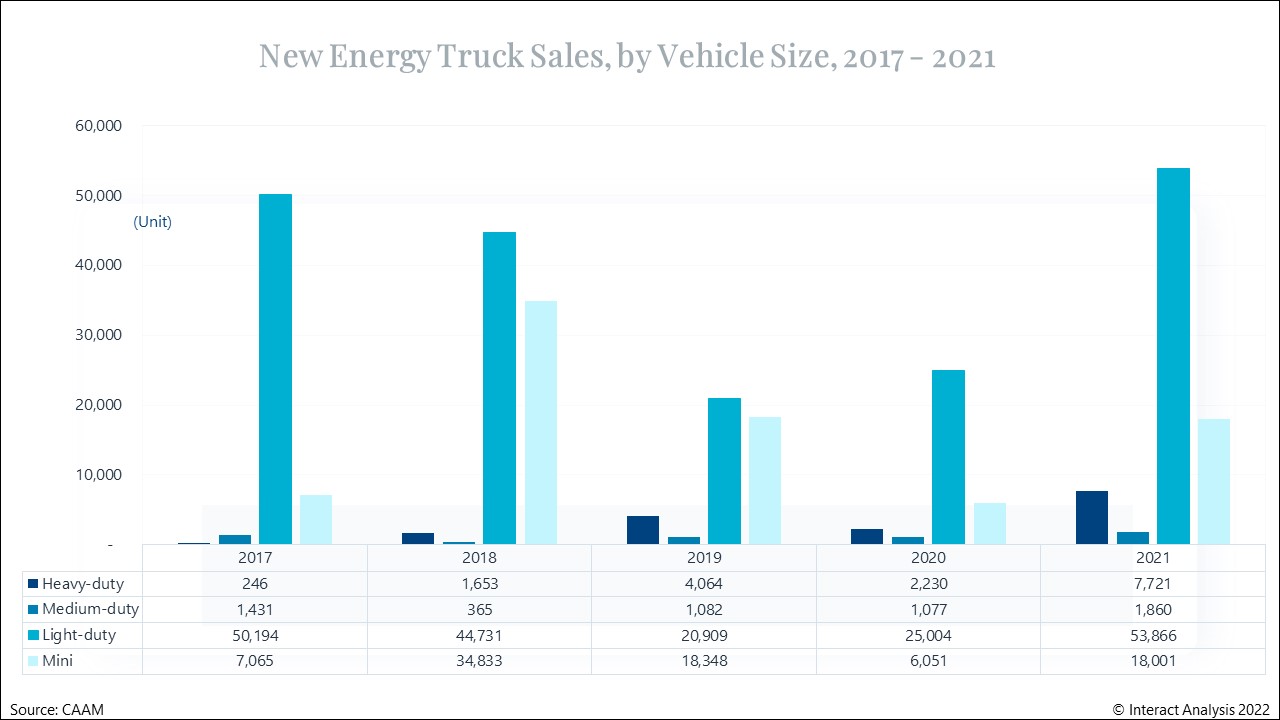

In 2021, NEVs accounted for nearly 20% of total bus sales, and a mere 2% of truck sales. Like with buses, overall NEV truck sales are driven by a specific vehicle category – in this case light duty and mini trucks – where the weight of the vehicle is no more than 6 tons. Light duty and mini trucks account for 90% of total EV truck sales.

The majority of these have been logistics and sanitation vehicles, both applications, like city buses, being well-suited for electrification. Market drivers include a variety of favourable government policies, such as privileged access to low/zero emission zones and the expansion of charging infrastructure.

The emergence of the heavy-duty electric truck

We can see from the chart below that, while light-duty and mini trucks have been the dominant force where new energy is concerned, electrification of heavy-duty trucks is on the increase, albeit from a very low base. For now, they are mainly used in short distance application scenarios such as in ports, mines, and steel plants. That’s partly because such applications are well suited to the limitations of NEV technology. But it also suits Chinese decarbonization initiatives well, since the government is particularly keen to curb the serious air pollution arising from heavy industries such as mines and steel plants.

Sales of heavy-duty NEV trucks grew from 246 in 2017 to 7,721 in 2021.

Sales of heavy-duty NEV trucks grew from 246 in 2017 to 7,721 in 2021. This represents strong growth but, for the heavy-duty NEV truck market to take off more widely in short distance applications, or to break into long distance applications, barriers will need to be broken. Likely possible solutions include the adoption of battery swapping capability, or the commercialization of viable fuel cell technology.

To continue the conversation about the commercial NEV market in China, get in touch with Shirly at our Shanghai office today: Shirly.Zhu@InteractAnalysis.com

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口