商用车

2022-11-14

中国动力系统厂商主导亚太电动车市场,但《通胀削减法案》的出台是否会阻碍其全球野心?

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

Chinese powertrain suppliers currently hold the majority of the global market share for electric commercial vehicle components such as batteries, motors and inverters. This is due to a strong domestic market and a range of Chinese government policies that have allowed domestic OEMs and suppliers to flourish. In recent years, Chinese OEMs and suppliers have eyed export markets as a much-needed source of growth as their home market becomes more competitive.

However, the US and Europe are trying to find ways of moving away from reliance on China for rare earth metals, lithium batteries and electric vehicles in general. Most recently, the US has passed the Inflation Reduction Act with the aim of localizing the production of lithium batteries and the raw materials associated with this. It is the most aggressive action that they have taken to confront the climate change crisis and will likely benefit small US companies and start-ups who aim to gain market share within the electric vehicle component market.

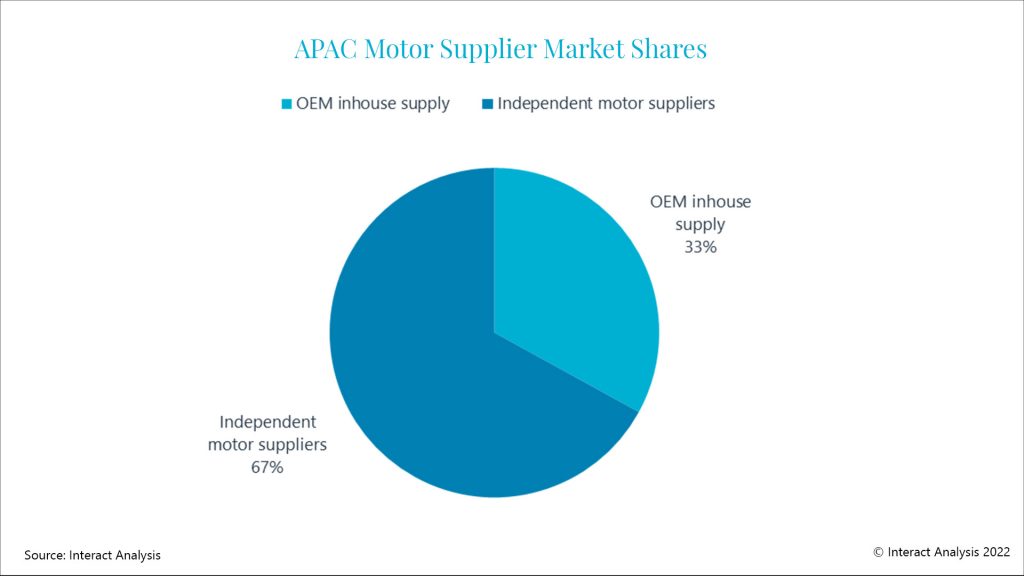

Chinese Companies Maintain Strong Market Share

Interact Analysis’ latest research has found a strong presence of OEMs in the battery pack and motor market. As shown in the market share table, in 2021, OEMs accounted for one third of total motor unit shipments in Asia Pacific. Chinese suppliers lead that for powertrain components such as battery packs, motors and fuel cell systems on the whole in Asia Pacific. This is testament to the fact that the country is the front runner for electrified truck and bus sales, and the component supply is dominated by local companies. This has created fierce price competition in the absence of global companies.

OEMs accounted for one third of motor unit shipments in Asia Pacific in 2021.

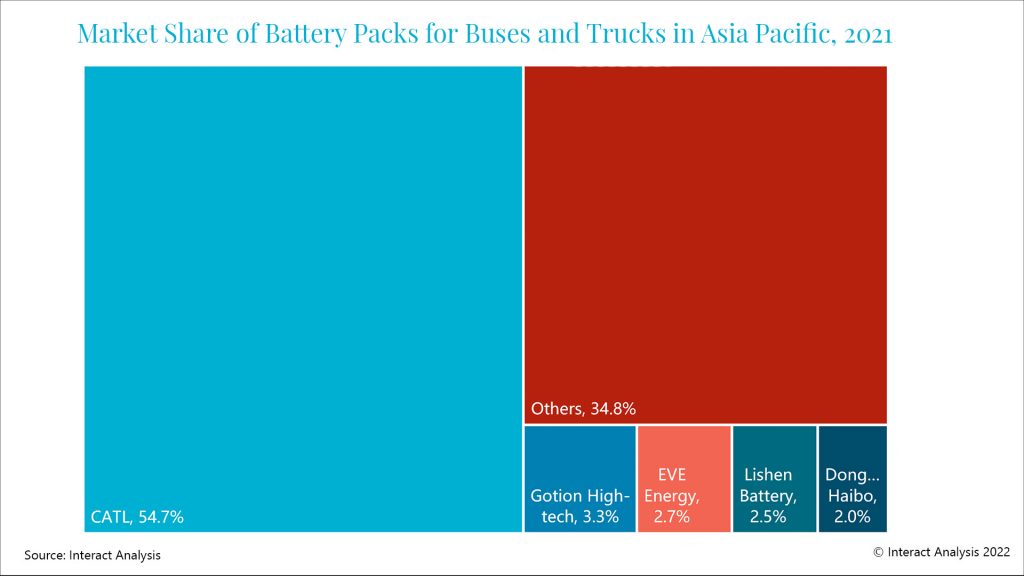

In the battery pack market, independent Chinese companies contributed approximately 85% of total battery pack shipments in 2021, and OEMs, led by BYD and Yutong, were estimated to have delivered 3.6 GWh or 15% of the total batteries shipped. All top 5 companies are Chinese vendors, accounting for 65% of total sales in 2021.

Chinese companies accounted for 85% of battery pack shipments in 2021.

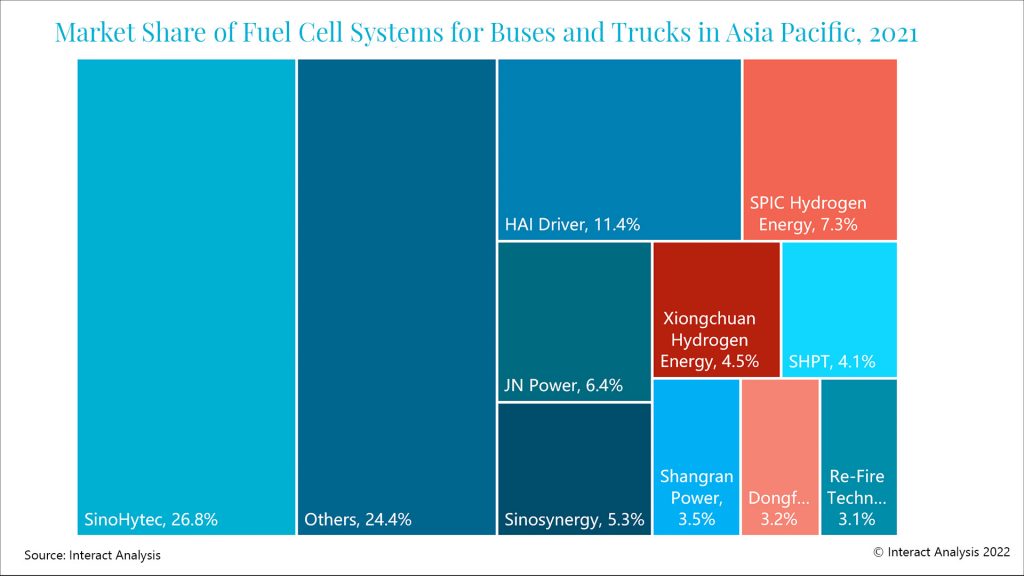

In the fuel cell system market, the Chinese market led demand for fuel cell vehicle shipments in Asia Pacific, accounting for 88% of total vehicle units, boosting fuel cell system sales in the country. As a result, Chinese companies dominated the sales of fuel cell systems in the Asia Pacific region, with the top 10 companies accounting for an estimated 75% of total unit shipments in 2021. Unlike with battery packs and motors, OEMs don’t engage in building fuel cell systems in-house in China. One major company in the Asia pacific region which does is Hyundai, based in South Korea.

Chinese companies dominated shipments of fuel cell systems in China with the top 10 companies accounting for 75% of total unit shipments.

The US Inflation Reduction Act

Because of the competition in the APAC electric commercial vehicle market, Chinese OEMs and suppliers are looking at export markets for growth. However, recent successes in Europe and the US might be in peril.

In addition to the subsidies that the US already provides for the purchase and manufacture of electric vehicles, the recently enacted US Inflation Reduction Act (IRA) is a separate bill that has been passed to localize the production of electric vehicles and the components that are used within them.

In order to qualify for the full subsidy, vehicles must be produced within the US and the batteries used within the vehicles must also be sourced within the US. Vehicles with batteries and even other materials that have been sourced from China will not qualify for the full credit. Therefore, this bill will potentially limit Chinese company EV sales to the US and consequently also that of batteries and perhaps other components that are manufactured in China.

Chinese companies will still have strong share in markets both home and abroad, such as Asia Pacific and South America. However, US and European suppliers will have the opportunity to grow with less competition against them. Despite this, the electric commercial vehicle market is less developed in the US compared to that of China, meaning it may end up growing less quickly without active Chinese suppliers and OEMs providing to the market.

Final Thoughts

Although Asia Pacific – specifically, China – leads the way by far for the electric vehicle component market, the likely impact that the US Inflation Reduction Act will have on suppliers in that market cannot be ignored. It will impact the market share that China and Asia Pacific currently hold within the component market whilst potentially damaging their relationship with the US. Nevertheless, Interact Analysis’ research suggests that demand will continue to soar within the Asia Pacific market for electrified trucks and buses with an increasing presence of component suppliers outside of China in the future. The big question is whether China can still build a supply chain within the US.

For more information on the electrified truck and bus market in China, please contact Shirly Zhu, Principal Analyst.

其他商用车领域洞察

非道路领域是否已迎来高性能计算平台时代?

2024年,巴西挖掘机进口五倍于出口