工业自动化

2022-08-12

中国制造业正努力摆脱阴霾,2022年预计将实现增长

MAYA XIAO

Maya在电动汽车、自动化系统和机器人领域拥有跨学科的技术背景,现担任Interact Analysis的研究经理,负责锂离子电池、叉车、工业和协作机器人市场等研究。

China’s manufacturing sector has shown strong resilience to the unprecedented challenges it has faced. Whilst it has by no means emerged unscathed from the pandemic, the signs are that Chinese manufacturing will remain strong and steady in the medium term.

The second half of 2022 – stability and recovery?

The first half of 2022 saw global economic growth slow down in the face of a range of negative factors including the after-effects of the COVID-19 pandemic manifesting in labor shortages, a dearth of raw materials and supply chain disruptions including blockages at ports and spiralling shipping costs. This has been exacerbated by rising energy costs, inflation, and the Ukraine war. Economic difficulties in China intensified in the first half of 2022 by the continued battle against fresh waves of COVID. This battle has seen Shanghai shut down and major cities across the country such as Beijing, Shenzhen, Xi’an, and Changchun struggle with the virus, restricting the flow of people and goods both within and between these cities. But there is optimism for the second half of 2022. It looks as if the worst of the pandemic is over. In Shanghai, production and foreign trade have both shown signs of recovery and we believe the Chinese economy is now playing catch-up. By the end of 2022, we expect to be able to report a reasonable growth rate for the whole of the year and our MIO output value for 2022 has been revised upwards slightly by 0.1% to 3.4% as compared with our last MIO forecast in May.

Fears of industry migration could be on the wane

On the 20th June 2022, Bloomberg reported that nearly one in four European firms are considering shifting production out of China as a result of ongoing COVID outbreaks and lockdowns. Our research suggests that the reality is that while the current challenging atmosphere might mean that investment has slowed down, China’s key role in global manufacturing is secure at least for the short to medium term. Behind the region’s huge manufacturing base there is a comprehensive and well-established industrial supply chain that has fared better during the pandemic than supply chains in other regions. Whilst it is true that some enterprises are transferring out of China into Southeast Asia, these are mainly industries which offer low added-value such as textiles and clothing, and electronic packaging and testing. And it’s partially a result of the up-skilling of the Chinese workforce and increasing expectations where types of employment and salary levels are concerned. Where some processes have moved out of China, the whole production remains largely dependent on the Chinese industrial supply chain. More complex industries such as automotive, semi-conductors and high-end electronics are more difficult to transfer out of the country on a large scale owing to their dependence on these established supply chains.

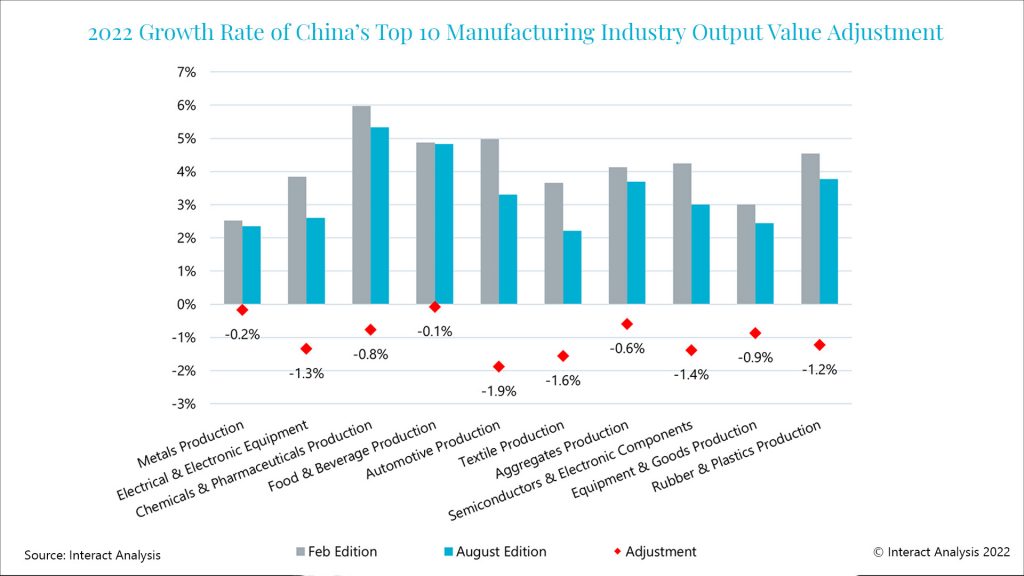

But output of major industrial sectors will contract

While these industries are secure in China, they have recently suffered badly during China’s struggles with the virus. Production in the automotive, semiconductor and electronic components sectors has been hit particularly hard because they are concentrated in areas which have been hit badly by new pandemic waves, such as Shanghai, Shenzhen, and Jilin. As compared with our February update (before Shanghai lockdown), we have revised our expectations of output value downwards for those sectors as can be seen in the chart below.

Production in automotive, semiconductor and electronic components has been hit particularly hard

Clear optimism when we look at the global picture

The chart below presents in the dark blue columns our latest 5-year forecast for the output value of the totality of Chinese manufacturing, with our earlier forecasts for February and May supplied for comparison. While we can clearly see a trend of increasing growth through to 2026, downward revisions of our growth projections are obvious from year to year. The COVID pandemic will cast a long shadow.

A trend of increasing growth in Chinese manufacturing output value through to 2026 is still projected

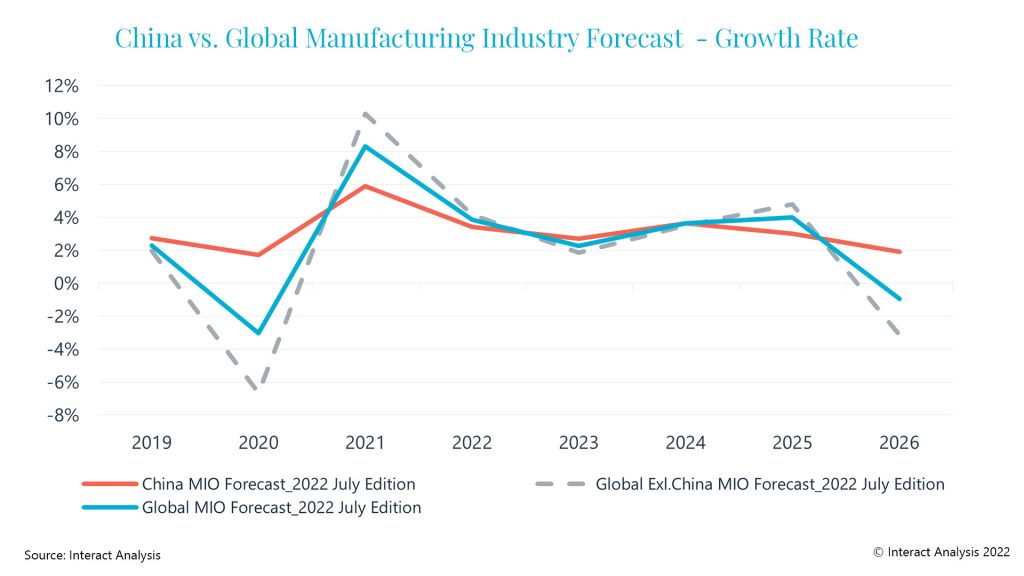

A more optimistic prospect for Chinese manufacturing comes into view when we compare the region’s performance with that of the global manufacturing economy as a whole, as represented in the chart below. The trajectory of the grey broken line, which represents the past and predicted fortunes of the global economy excluding China, tells a story of extreme turbulence, while the red line, which represents our MIO forecast for China alone, while consistent with the global trend, has a far smoother trajectory and is evidence of the past and predicted comparative stability and resilience of the Chinese manufacturing sector.

Compared to the global trend, Chinese manufacturing is projected to be more stable and resilient

For an in-depth perspective on the short to medium term prospects for Chinese manufacturing, contact Maya Xiao today: maya.xiao@interactanalysis.com

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方