工业自动化

2020-09-17

2020年及未来的中国制造业将如何表现?

MAYA XIAO

Maya在电动汽车、自动化系统和机器人领域拥有跨学科的技术背景,现担任Interact Analysis的研究经理,负责锂离子电池、叉车、工业和协作机器人市场等研究。

Along with our recently published Manufacturing Industry Output (MIO) Tracker August update, we also provide a deeper insight into the largest manufacturing site – China.

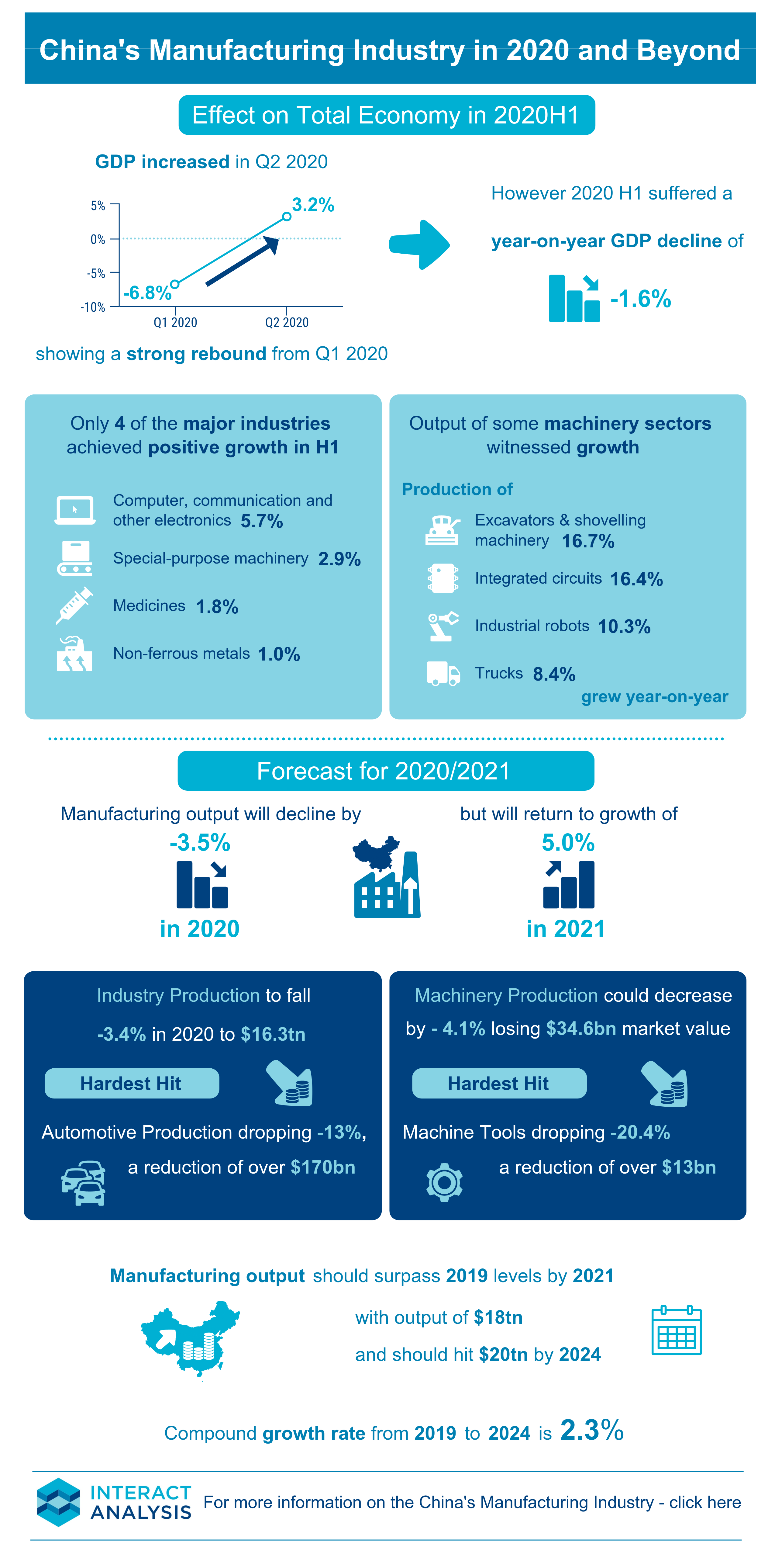

The outlook for China’s manufacturing industry is slightly more optimistic than the forecast made during our last MIO update in April 2020. The rapid rise for certain sectors in 2020 Q2 has made the overall situation of 2020 H1 better than previously expected. The below infographic demonstrates some of the key findings from our report.

China’s Manufacturing Industry Infographic

The infographic is also available to download in PDF here.

China’s GDP increase 3.2% in Q2’20 compared to Q2’19, showing a strong rebound from -6.8% in Q1’20. Together these mean the 2020H1 suffered a year-on-year decline of -1.6%.

Only four of the major industries in 2020H1 have achieved positive growth, namely: manufacture of computer, communication equipment and other electronic equipment (5.7%); manufacture of special-purpose machinery (2.9%); manufacture of medicines (1.8%); and manufacture and processing of non-ferrous metals (1.0%).

The output of some machinery sectors witnessed fast growth. In the first half, the production of excavators and shoveling machinery, integrated circuits, industrial robots and trucks grew by 16.7%, 16.4%, 10.3% and 8.4% year-on-year, respectively.

Based on the current situation, we predict that China’s manufacturing output will decline by -3.5% in 2020 and will return to growth of 5.0% in 2021. Again, this is slightly more optimistic compared to our April forecast which predicted a decline by -4.0%in 2020.

We expect Industry Production to fall 3.4% in China in 2020 to $16.3 Trillion USD from $16.9 Trillion in 2019.

Machinery Production could decrease as much as -4.1% losing $34.6Bn of market value from the previous year.

The heaviest hit Industry production is Automotive Production dropping -13.0% a reduction of over $170 Bn.

The heaviest hit machinery sector is Machine Tools which has negative growth of -20.4%. going from $64.2Bn to $51.1Bn from 2019 to 2020.

China should surpass 2019 levels by 2021 with a MIO output of $18.0 Trillion and should hit $20 Trillion by 2024, the compound growth rate from 2019 to 2024 is 2.3%.

最新工业自动化洞察

2025年全球工业机器人出货量有望复苏

Li-Cycle倒下,电池回收市场将走向何方