商用车

2022-05-09

换电模式将快速推动中国重型车的电动化

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

As the market for new energy vehicles continues to surge in most major economies, it’s become accepted wisdom that one vehicle type that will not make a significant breakthrough into clean energy any time soon is the heavy-duty vehicle. Technical barriers, mainly concerning battery power and vehicle range, appear to have ruled out widespread battery electrification of heavy vehicles, and hydrogen fuel cell technology is stuck at an earlier stage of development. However, some newly covered market trends in China are causing us to partially rethink this issue. It’s not before time: in March 2022, China Daily reported that trucks and buses accounted for more than 50% of greenhouse gas emissions from road traffic in 2020.

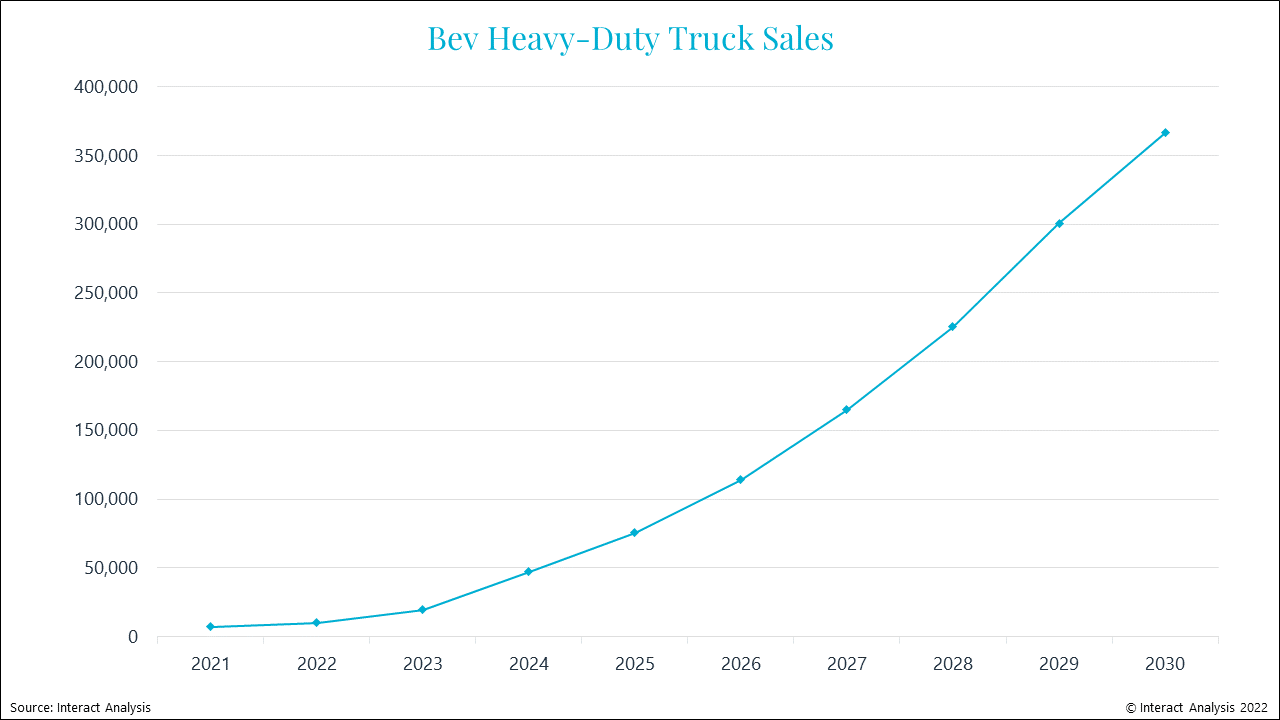

Over 350,000 BEV heavy trucks predicted to be sold in 2030

Sales numbers of battery electric heavy-duty trucks in the region have increased significantly in the past year, though they remained comparatively small – around 1% of total heavy duty truck sales. But we believe these numbers are set to increase dramatically. Our data indicates that this increase isn’t just a blip, but part of an overall trend which will result in very strong sales numbers by 2030.

Let’s start by looking at some figures. Overall, truck sales in China in the first quarter of 2022 were weak, with a decline of 44% compared to Q1 2021. But in the same period, new energy truck sales increased by 231% to 13,191 units and within that figure, new energy heavy duty truck sales soared by 664%, with 4,729 units being sold in Q1 2022. Battery electric is the dominant powertrain type, powering 98% of those trucks. Our forecasts show sales of battery electric heavy-duty trucks will exceed 350,000 by 2030 (see graph below).

Sales projections for battery electric heavy duty trucks out to 2030

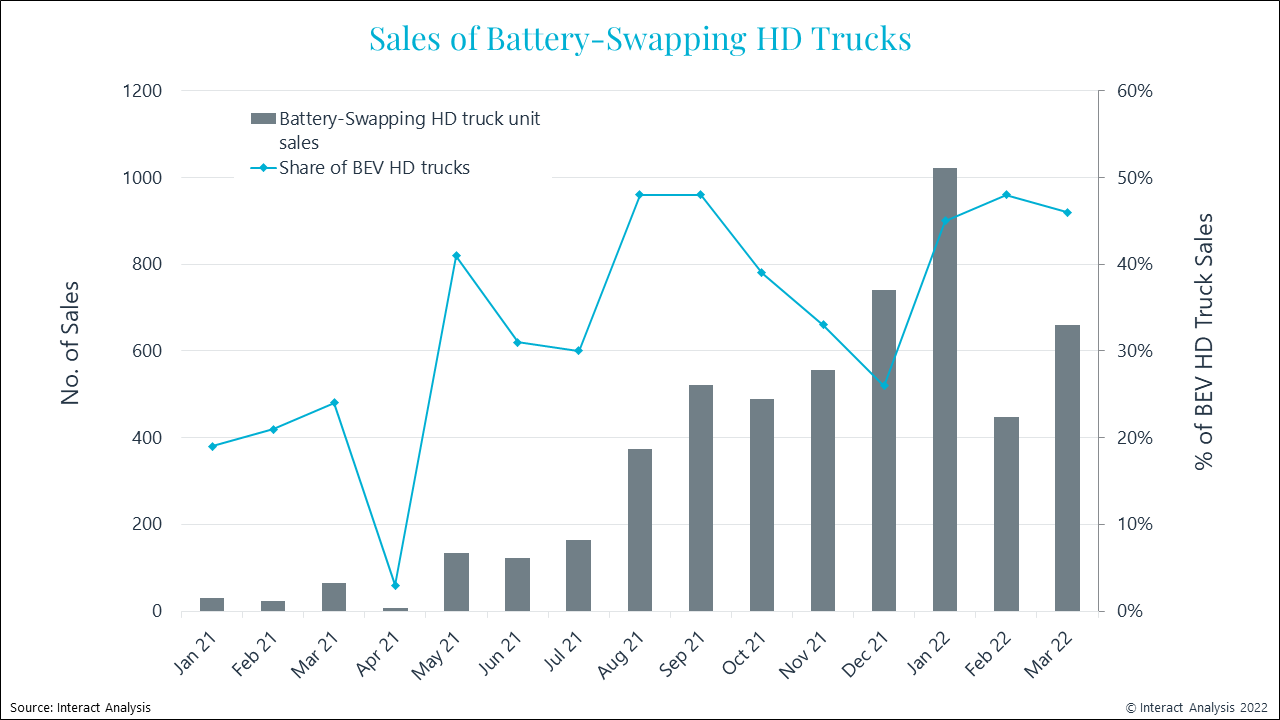

So, why is this happening in China? It’s largely down to government-driven initiatives in the face of increased concern about pollution levels in cities which have become powerhouses of economic activity, modernization, and growth. There are also outside pressures such as the soaring cost of oil. China is driving this market with battery-swapping technology, and is arguably showing the rest of the world how it can be done, just as they did with electric buses. The actual sales numbers for battery swapping heavy duty trucks are small, but they are growing fast. Thirty heavy duty trucks running on battery-swapping technology were sold in January 2021. Those sales made up 19% of the total sales of BEV heavy trucks. In January 2022, 1,022 battery swap heavy trucks were sold, accounting for 45% of total pure electric heavy truck sales. A significant increase in both number and share.

Sales of battery swapping heavy duty trucks

Government initiatives power battery-swap roll-out

In the second half of 2021, the Chinese government announced a pilot program to promote battery swapping solutions for heavy duty trucks in three cities – Baotou in Mongolia, Tangshan in the Hebei province, and Yibin in the Sichuan province. These cities host important industrial areas, Baotou is focused on mining, Hebei is China’s biggest metal producing region, and Yibin is a production base for major battery manufacturers such as CATL, the company which is installing the battery swapping infrastructure in these regions. As such, Yibin has a compelling industry chain for setting up battery swapping operations. Most battery swapping routes in this pilot program are for short routes – typically 100-150 km, with the trucks often being used internally in mines and industrial sites. However, this is part of a wider battery swapping infrastructure roll-out for all electric vehicles that use the technology which will focus on 11 cities. The aim of the pilot is to increase the number of vehicles with battery-swap technology to over 100,000 and build over 100 battery swap stations.

Government initiatives have been the catalyst for further developments in battery swapping infrastructure.Yicai Global recently reported that a 175 km section of highway between the cities of Ningde and Fuzhou has been equipped with battery swapping stations for heavy goods vehicles, and they have been in use as from February 2022. The intention is to extend this to other regions. CATL considers heavy duty trucks to be particularly suitable for battery swapping technology because the routes of commercial trucks are fixed, making the cost of installing battery swap stations relatively low.

The challenges ahead

There are challenges ahead which need to be resolved. Perhaps the most important is the current lack of standardization among battery suppliers, with regard to battery shape, size, and compatibility. Until uniformity is achieved across the industry, battery-swapping operators are going to struggle to offer a comprehensive service and be financially viable. There are also safety concerns around the storage of large numbers of batteries at a swapping facility, and reservations in relation to the major investment required in acquiring banks of swappable batteries, when there are still questions regarding the lifetime of batteries and the number of times they can be charged and recharged. But trends in the market speak for themselves, and battery swapping in China for heavy duty vehicles is in a growth phase.

To continue the conversation about how battery swapping technology will be applied to heavy-duty trucks, contact Shirly Zhu today: Shirly.Zhu@InteractAnalysis.com