机器人 & 仓储自动化

2021-12-14

机场物流自动化市场:技术新,发展慢

Jamie Fox

Jamie拥有超过15年行业研究经验,研究范围涵盖了商用车及其动力总成零部件系统。他拥有物理学和天文学学士学位,以及纳米科学与技术硕士学位。Jamie目前在智利工作。

Airport logistics managers are a conservative bunch. And with good reason: if you lose a passenger’s luggage, you’ve got a very angry passenger. Airports also run complex decision making processes. These differ by country, but investment often requires the assent of local governments and airlines, as well as airports. All this means that, when it comes to adopting new logistics automation technologies in airports, the pace can be slow. On the other hand, airport logistics is comparatively easy to automate, and the benefits can be substantial.

Airport logistics automation is therefore a market open to change… but slow change.

Logistics and airport logistics

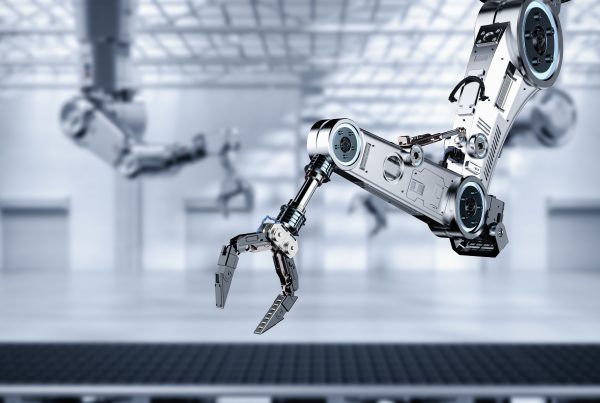

Logistics automation as a wider sector is seeing stunning growth, driven by the rise of e-commerce. R&D budgets at logistics automation companies are large, and the pace of innovation in the sector is intense. There is therefore a lot of new tech on the logistics automation scene that can easily be adapted for airports.

Overall, airport logistics automation is a $3bn market that splits into three clear segments. Baggage handling systems dominate with $2bn revenue – and this segment is where we see the vast majority of technological innovations taking place. Cargo handling systems make up $0.4bn and software makes up $0.6bn.

The self-service automation trend

Using simple automation to enable people to serve themselves in a commercial setting has caught on in a big way in supermarkets. There is no reason similar tech can’t be deployed in airports. This promising technology generally sees passengers take charge of all steps of the bag drop process, from weighing, to tagging, to even scanning their own boarding passes. Technologies used in this process can include bar code scanners, RFID systems, and image-based code readers.

The benefit to the passenger is simple and obvious: massively reduced queuing times. And there is no doubt that COVID has given a bit of momentum to any technology that limits face to face contact. Schiphol airport is a market leader in self-service, with about 80% of bag drop offs already done this way.

Picture Courtesy of Beumer

Self bag drop systems were a comparatively small 3.4% of baggage handling systems revenue in 2019 – $60 million. By 2025, this will have more than doubled to 6.9% ($127 million). A small market share then, but the growth potential is impressive.

Mobile robots – strong opportunity in cargo handling

Mobile robot use in airports is very small for now, and mostly takes the form of pilot projects. The total 2020 market size was $33 million (including both AGVs and AMRs). Penetration will remain limited out to 2025, but airports and installers are open to using mobile robots in the long-term, if they feel that the technology has proved itself. One example of a real-world deployment is at Dallas Fort Worth Airport, which you can watch on YouTube here.

We predict strong long-term opportunity for deployment of mobile robots in the cargo handling systems market in particular, given the clear similarities to the warehouse market where mobile robots have enjoyed widespread adoption.

Individual carrier systems

Individual carrier systems – where baggage is carried along belts and systems on individual trays is well-established. On the other hand, in the context of airports, it’s still a relatively more recent and growing technology. For example, individual carrier systems had a 37% share of sortation revenues in 2020, which will grow to 46% by 2025. While such systems have a high initial investment, they are well-liked by the market because they offer efficient tracking and low maintenance and operation costs that more than offset the initial cost.

Long-term thinking

Since this is a slower moving market, a long-term view when considering automation trends is essential.

Reclaim on demand is a technology where passengers receive a notification on their phone saying that their bag is ready for collection. This can be from the carousel, or from a secure location where the passenger needs a code to access their baggage. Use currently is minimal, and will remain so out to 2025. But in a 10-15 year timeframe such solutions are likely to be ubiquitous.

Software is also promising. Already the second largest segment in the airport logistics automation market, we expect software to grow in importance particularly when it comes to data analytics and simulations. Airports will follow other industries in this regard, with predictive maintenance solutions likely to become significant. Again, this is a long-term trend and for now the hardware/software revenue ratio will not grow significantly.

To learn more about airport logistics automation, contact Jamie today: Jamie.Fox@InteractAnalysis.com

最新机器人&仓储自动化洞察

2025年全球工业机器人出货量有望复苏

人形机器人核心硬件的发展现状和趋势