机器人 & 仓储自动化

2023-05-05

到2027年,预计全球26%的仓库将实现自动化

Rueben Scriven

Rueben是全球仓储自动化行业中领先的研究分析师之一,经常在全球重要的行业活动上发表演讲,主持过多个行业研讨会。

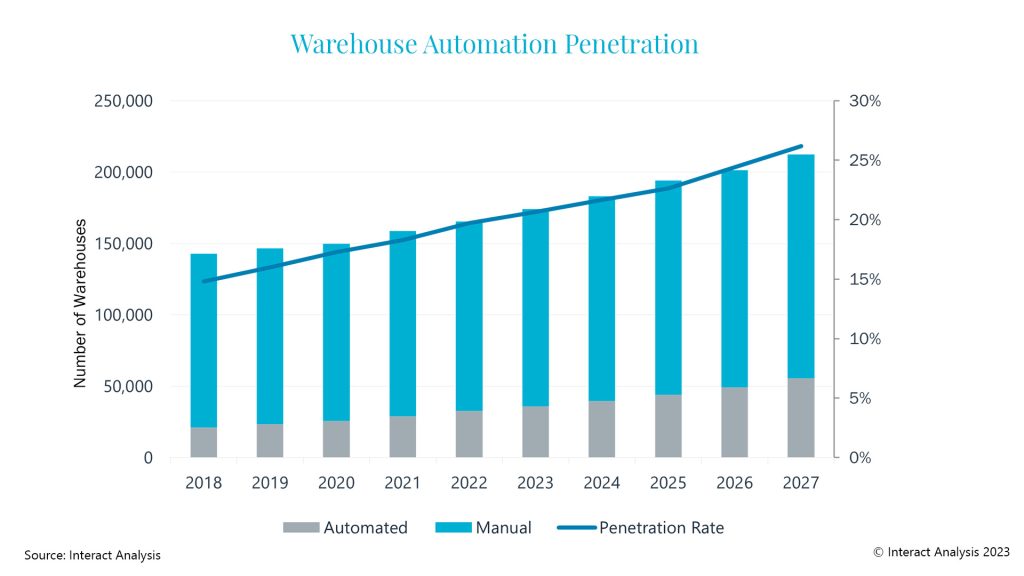

More than a quarter (26%) of warehouses are expected to be automated by 2027, from 14% just a decade earlier.

Momentum is growing for automation of warehousing operations and is expected to through to 2027 when one-quarter of sites (26%) will have some form of automation installed.

This is a steep rise from just 18% at the end of 2021, demonstrating how a number of key factors, including labor shortages and the acceleration in e-commerce fueled by the Covid-19 pandemic is driving the market.

Warehouse automation penetration is to continue expanding steadily through to 2027

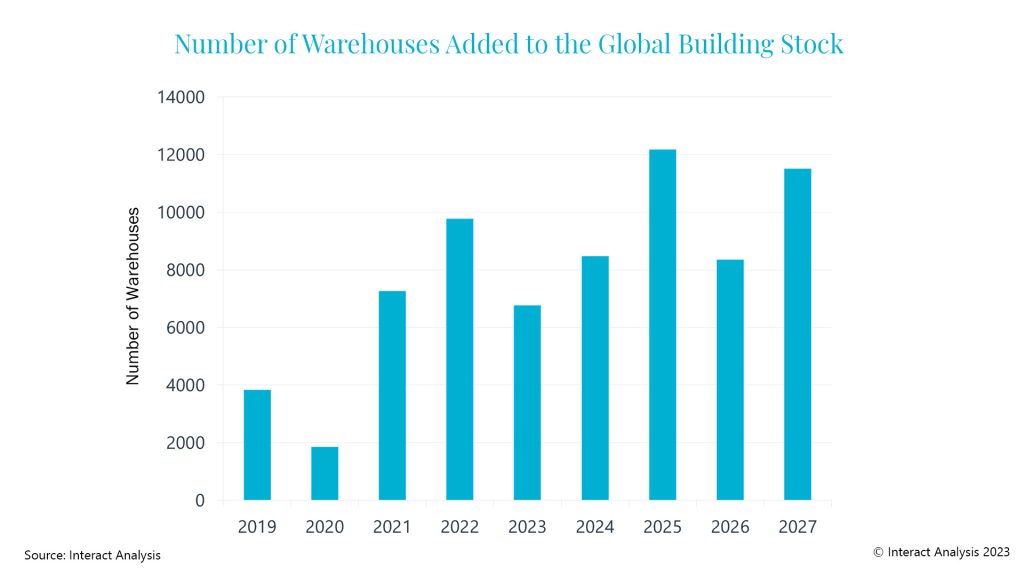

Automation investment to continue despite dip in warehouse construction

According to our forecasts, the use of automation in warehousing will continue to expand. This is despite a predicted fall of 35% in the number of new warehouses added to global building stock during 2023 compared with the previous year, largely as a result of the global economic downturn and a post-Covid market correction.

Although we are expecting a dip in demand for end-to-end automation solutions in the short term, many companies are expected to continue to spend on automation, focusing instead on their existing assets, rather than investing in new or larger automation projects.

Our latest report on warehouse buildings, footprint and labor shows the food & beverage, and parcel sectors have the highest penetration rate of warehouse automation, and they will continue to be ‘low hanging fruit’, due to both the predictability of throughput and the size/weight of items handled.

Despite the high growth forecast for warehouse automation systems, market saturation remains a long way off. For example, the ROI of an automated sortation system is high as a result of the increased throughput rates it offers compared with manual sortation, coupled with the potential to reduce labor costs and fill skills gaps.

Slowdown in e-commerce and high interest rates push global warehouse construction rates down

Although investment in automation is set to continue, our analysis indicates the global economic downturn, high interest rates and the slowing trend towards e-commerce have hit warehouse construction hard, in particular fulfillment centers. As a result, the number of new warehouses added to global building stock is anticipated to drop from nearly 10,000 in 2022 to 6,700 in 2023, but still above pre-COVID levels.

The number of warehouses added to building stock is expected to dip to 6,700 in 2023

This fall in warehouse construction is in part because of Amazon’s decreased spend on new facilities, having doubled its fulfillment capacity between 2020 and 2021. According to our latest research, 4,000 fulfillment centers were added to the global building stock during 2022, a figure that looks set to drop to 2,000 in 2023, with some recovery in construction rates expected the following year.

However, a slowdown in warehouse construction will be short-lived

We don’t think this 2023 dip in warehouse construction is due to an underlying lack of demand, but is more the result of the current economic climate, high interest rates and the sheer volume of capacity added in 2021 and 2022. With this in mind, the slowdown in warehouse building is likely to be short-lived. As demand remains fairly consistent, we predict rent prices will increase in the mid-term and e-commerce will continue to drive demand for new facilities over the longer term.

Global e-commerce online sales are projected to more than double over the five years to 2027, driving growth in global warehouse stock of 28,500, a large proportion of which are expected to be direct-to-consumer fulfillment centers, which will require substantial automation and labor.

China and the US lead the way in warehouse construction

In terms of warehouse construction, China and the US are leading, accounting for 58% of the total square footage added in 2022 between them. Over the year US warehouse stock increased by 6% and China’s by 5%, with the lowest levels of growth in terms of additional warehouse square footage recorded in Japan and France last year.

Near-shoring trend looks set to continue

Looking to the future, the Inflation Reduction Act in the United States and the trend towards re-shoring and near-shoring manufacturing production means following supply chain disruptions resulting from the COVID-19 pandemic is likely to increase the number of durable manufacturing warehouses in Europe and North America.

This represents a significant opportunity for warehouse automation vendors, particularly as labor costs are often significantly higher than in APAC where much of the manufacturing activity is shifting away from. Indeed, we have heard anecdotally from many warehouse automation vendors they have seen significant increases in investments from manufacturers over the past 12 months.

For more information on our quarterly updated Warehouse Building Stock Database report, download our brochure.

最新机器人&仓储自动化洞察

2025年全球工业机器人出货量有望复苏

人形机器人核心硬件的发展现状和趋势